read

There is no difference between Limited and Ltd at the end of your company name. It's a matter of stylistic preference. Ltd is an abbreviation of limited.

🔑 Key Highlights

- There’s no legal distinction between "Ltd" and "Limited" for companies; both signify limited liability status.

- The choice between "Ltd" and "Limited" is mainly stylistic, allowing businesses the flexibility to choose whichever best suits their brand.

Why do some uk companies use 'ltd' or 'limited' in their names?

In the UK, private limited companies are legally required by section 59 of the Companies Act 2006 to end their names with "Limited" or "Ltd" to indicate limited liability status. This suffix signals that the company is its own legal entity, with shareholders protected from personal liability if the business faces financial issues. Welsh companies may use the equivalents "cyfyngedig" or "cyf."

Without one of these suffixes, Companies House will not register the company unless it meets specific exemption criteria.

According to Section 59 of the Companies Act 2006, private limited companies in the UK must end their names with either "Limited" or "Ltd" to indicate their limited liability status. Welsh companies can also use "cyfyngedig" or "cyf." However, if a company name does not contain the appropriate suffix, Companies House will refuse its registration unless it qualifies for an exemption.

Also related: Limited Liability Definition Business

Are there companies exempted from using Limited in a company name?

Certain companies— particularly those limited by guarantee —can be exempt from adding "Ltd" or "Limited" to their names.

To qualify, these companies must operate with specific objectives in their articles of association, such as promoting commerce, education, charity, or other community-benefitting pursuits. Additionally, they must meet several conditions:

- Income allocation: All profits must be directed toward the company’s stated objectives.

- Prohibition of payments to members: No dividends or returns of capital can be paid to members.

- Asset transfer upon dissolution: In the event of winding up, assets must be transferred to an organisation with similar objectives or one that promotes charitable causes.

Other entities may use different suffixes. For example:

- Public Limited Companies use "PLC."

- Limited Liability Partnerships use "LLP."

- Sole traders with trading names do not use a suffix.

These distinctions allow companies to represent their structure and purpose accurately.

What is the difference between LTD and Limited?

The difference between "Ltd" and "Limited" is purely stylistic—“Ltd” is simply an abbreviation of “Limited.” Private limited companies commonly use either of the terms to show limited liability status. The choice depends on the company’s preference and doesn’t affect the company’s legal standing or obligations.

Once you choose your preferred suffix, it will appear at the end of your business name in your certificate of incorporation and on the Companies House register.

How do I determine whether to use Limited or ltd at the end of your company name?

You can use "Limited" or "Ltd", depending on which fits your brand’s style best. Legally, there’s no difference, and both indicate limited liability status. While "Limited" may feel more formal, many formal brands opt for "Ltd" as well—so it comes down to your personal preference!

Are 'ltd' and 'limited' interchangeable?

While “Ltd” and “Limited” can generally be used interchangeably without issue, using the version you registered with Companies House on all official documents and legal correspondence is essential. Consistency with your registered name is required in the following instances:

- Physical signs (e.g., in shops or commercial offices)

- Your registered office address or any operating business location (excluding your home if used privately)

- Stationery, including official documentation and websites

- Promotional materials

Following this practice helps maintain compliance and ensures clarity in all official interactions.

read

Find your unique taxpayer reference number (UTR number) printed in any correspondence from HMRC, such as letters or tax returns.

🔑 Key Highlights

- A personal UTR number is a unique identifier assigned to individual taxpayers by HMRC to manage their tax records and self assessment filings.

- If you’ve lost your UTR number, check any past correspondence from HMRC, such as tax return reminders, statements, or your self assessment welcome letter.

- Your UTR number is permanent and remains with you for life, regardless of changes in your employment or personal circumstances.

What is a UTR number?

A UTR (Unique Taxpayer Reference) number, also known as a tax reference, is a 10-digit number issued by HMRC to individuals and limited companies in the UK. It is primarily used for registering and managing self assessment tax return for individuals. This number is essential for sole traders, freelancers, and anyone with untaxed income to file their personal tax returns and pay income tax accurately.

Who needs a UTR number?

A UTR number is essential for anyone who needs to register for Self Assessment with HMRC. You will need a UTR number if you have any untaxed income, including the following:

- Partners in general partnerships, limited partnerships, or limited liability partnerships (LLPs).

- Freelancers and self-employed individuals with annual earnings exceeding £1,000.

- Persons receiving rental income above £2,500 from land or property based in the UK.

- Contractors and subcontractors under the Construction Industry Scheme.

- Individuals earning capital gains above the allowance of £3,000.

- Employees claiming annual expenses above £2,500 per year.

- Shareholders receiving annual dividends above £10,000.

- Any individual with a taxable income of over £150,000.

- People who receive foreign income of any amount.

- Company directors with untaxed income.

If you receive income not taxed at the source or fall into any of these categories, you will need a UTR number to file your tax returns and comply with HMRC requirements.

See also: Limited Liability Partnership (LLP) Advantages and Disadvantages

How do I register for a unique taxpayer reference number?

To register for a personal UTR number, follow these steps:

- Visit the official HMRC website: https://www.gov.uk/register-for-self-assessment.

- If you are self-employed, you need to register for both Self Assessment and Class 2 National Insurance Contributions.

- Use your Government Gateway User ID and password to access the registration portal.

- You will need to supply the following personal and business information:some text

- Personal Details (such as your name, date of birth, national insurance number, contact information and home address)

- Business Details (including your trading name, business address, business start date and the nature of your business.)

- HMRC provides a helpful video guide that walks you through the registration process. Use it for additional clarity.

- Once registered, HMRC will send your UTR number by post within 1-2 weeks. You will also receive an activation code, which must be used to activate your account within 28 days of receipt.

Following these steps ensures your successful registration for a UTR number and compliance with HMRC requirements.

How do I get a business tax number?

When you register a company in the UK, your business tax number, known as the Unique Taxpayer Reference (UTR), is automatically assigned by HMRC and is used as part of the corporation tax process. As part of the registration process with Companies House, you will receive a certificate of incorporation, which confirms your company has been officially registered. Shortly after this, HMRC will send your company UTR number to the registered office address you provided during registration.

This 10-digit UTR number is crucial for managing your business’s tax obligations, including filing tax returns and correspondence with HMRC. If you don’t receive your UTR number within a few weeks of incorporation, you should contact HMRC to ensure everything is in order.

I've lost my UTR number. Can I get a new one?

You cannot get a new number, as it is assigned to you for life and remains the same regardless of changes in your circumstances. However, if you have lost it, you can easily retrieve your self assessment unique taxpayer reference.

How do I find your utr number?

If you previously registered for Self Assessment through HMRC's online service, you would have received your UTR number by post within 10 days of registration. If you’ve misplaced it, you can retrieve it through the following methods:

- HMRC App or Personal Tax Account: Log in to your personal tax account or the HMRC app, where your UTR number is displayed under your tax details.

- Past Correspondence from HMRC: Check any letters or emails from HMRC, such as your self-assessment welcome letter, which includes your UTR number.

- Contact HMRC Directly: If you cannot find your UTR number using the above methods, you can contact HMRC directly. Be prepared to provide personal details to verify your identity.

Remember, your UTR number is unique and permanent, so retrieving it ensures continuity in managing your tax obligations.

Do I need a unique tax reference to register for self assessment?

No, you do not need a UTR number to start the registration process for Self Assessment. When you register for Self Assessment through HMRC’s online service, you use your Government Gateway credentials to complete the process. After registering, HMRC will generate your UTR number and send it to your registered address by post.

Will I need to change my unique tax reference number if I change jobs?

No, your UTR number is permanent and does not change, even if your self-employment circumstances change. HMRC assigns it to you for life, and it remains the same whether you are employed, self employed, or switching between different types of work.

Your UTR number is tied to your tax records, not your employment status. It will remain valid for all tax-related activities, including self assessment filings or other tax obligations. Keep it safe, as it will remain essential to your interactions with HMRC.

Can I register for a UTR number if I am not self employed?

Yes, you can register for a personal UTR number even if you are not self-employed. A UTR is required for anyone who needs to file a self-assessment tax return. This includes individuals with untaxed income from sources such as:

- Rental property income.

- Employee expense claims exceeding £2,500 per year.

- High-income earners with over £150,000 annually in earnings.

Even if you are employed, certain circumstances may require you to register for self-assessment and obtain a UTR number to report your income and ensure compliance with HMRC regulations.

Do you need a UTR number to submit your return?

Yes, you need a personal tax number to submit your returns. This 10-digit number is essential because it links your tax return to your tax records and income history with HMRC. Without it, HMRC cannot process your return or accurately record your tax information.

Can I access my UTR number if I don’t have my HMRC login details?

If you lose your HMRC login details, you can still access your UTR number. One of the simplest ways to find it is to check past correspondence from HMRC. Your UTR number is included on documents such as your self-assessment welcome letter, tax return notices, payment reminders, or statements of account, which should have been sent to the address registered with HMRC.

If you cannot locate any correspondence, you can recover your Government Gateway ID or password. To do this, visit the HMRC sign-in page and select the option to retrieve your login details. You’ll be guided through a process to verify your identity, which requires access to the email address associated with your Government Gateway account.

Once you’ve regained access to your account, you can log in to your personal tax account or the HMRC app, where your UTR number will be displayed. If you cannot recover your login details or encounter difficulties, you can also contact HMRC directly to retrieve your UTR number.

How do I contact HMRC to request a lost UTR number?

You can reach out to HMRC using the following methods:

- Social Media (X, formerly Twitter):some text

- Handle: @HMRCcustomers

- Opening hours:some text

- Monday to Friday: 8 am to 8 pm

- Saturday: 8 am to 4 pm

- Telephone:some text

- Within the UK: 0300 200 3600

- Outside the UK: +44 161 930 8445

- Phone line opening hours:some text

- Monday to Friday: 8 am to 6 pm

- Closed on weekends and bank holidays.

When contacting HMRC, make sure to have any relevant details, such as your National Insurance number, to expedite the assistance process.

UK Personal UTR Number Explained.

read

A company registration number is a unique identifier issued by Companies House when your company is registered.

🔑 Key Highlights

- A company registration number is a unique alphanumeric code provided by Companies House upon registration to identify businesses incorporated in the UK.

- It is also called the ‘Company Number,’ especially on the certificate of incorporation or ‘Companies House Registration Number.

- Sole traders and general partnerships, not registered at Companies House, do not have a CRN. However, limited companies have one, including LTDs, limited liability partnerships (LLPs), and limited partnerships (LPs).

- A company registration number remains the same for the entire lifetime of the company.

What is a crn number?

A company registration number (CRN) is a unique identifier consisting of either eight digits or two letters followed by six digits. It is issued by Companies House to distinguish limited companies in the UK.

This number may also be called a company number, Companies House number, incorporation number, or business registration number.

See also: What does limited liability mean?

Who needs a company registration number?

A company number is essential for businesses registered with Companies House. If you operate a limited company or LLP, you will need a CRN for the following purposes:

- Filing and updating company records with Companies House: Your CRN is required for any activity involving the Companies House online filing system (WebFiling or a Companies House account), such as:

- Submitting annual returns (Confirmation Statements).

- Filing accounts and copies of resolutions.

- Making amendments to company details, including:

- Changing your company name.

- Updating your registered office address or Single Alternative Inspection Location (SAIL) address.

- Adjusting your Accounting Reference Date (ARD).

- Modifying your company structure, such as adding, removing, or changing details of a director or company secretary.

- Increasing share capital or issuing share certificates.

- Tax-Related Dealings with HMRC: You’ll need your CRN for tax administration, such as:

- Registering for VAT.

- Filing Company Tax Returns.

- Paying Corporation Tax, VAT, or Income Tax.

- Issuing dividend vouchers.

- Processing National Insurance contributions via PAYE.

- Business operations and compliance: Your CRN is required for several official and business activities, including:

- pening a business bank account.

- Signing contracts on behalf of your company.

- Applying for funding, grants, or tenders.

Having your registration number readily available ensures you can efficiently manage your company's statutory obligations and conduct official business operations.

Where do I find your company registration number?

You can find my company registration number in any of the following:

- Certificate of incorporation: The primary place to find your CRN is on the incorporation certificate issued by Companies House when your company was registered.

- Official correspondence: Look for the Companies House number on any Companies House or HMRC correspondence.

- Companies House online register: Visit the Companies House website and search for your company by name. The search results will display your CRN.

- Certificate of name change: If you recently changed your company name, the CRN will be listed on the Certificate of Incorporation for the Change of Name.

- Emails or Communications from Your Formation Agent or Accountant: Your CRN may also appear in emails, reports, or documents from your company formation agent or accountant, as they often reference it in their communications.

By checking these sources, you can quickly locate your CRN whenever needed.

✅ Insight

Your company’s registration certificate and any statutory correspondence from Companies House will prominently display your company registration number (CRN). It is typically printed alongside or beneath headings like “Company Number.”

To locate your company registration number in the public register, you can perform a free Companies House search by following these steps:

- Visit Companies House - Find and Update Company Information.

- Enter your company’s name in the search box.

- Click the “SEARCH” button.

- Your company number will appear below your company name in the search results.

This process makes it simple to find your CRN quickly and at no cost.

If I change my UK company name, will I get a new crn?

No, your company registration number (CRN) will remain the same even if you change your business name. The CRN is a unique identifier assigned by Companies House that remains constant throughout the life of the company, regardless of any changes to its name, address, directors, shareholders, or business activities.

When you change your company name, Companies House will issue a Certificate of Incorporation on Change of Name. This document will include your new company name, the date of the change, and your unchanged CRN.

Do I need a CRN if I am a sole trader?

No, as a sole trader, you do not need a company number because sole trader businesses are not registered with Companies House. As such, you will not receive a certificate of incorporation or a CRN; neither is required for your business operations.

Instead, a Unique Taxpayer Reference (UTR) number issued by HMRC is essential for sole traders. This number is used to identify your business for tax purposes and is necessary for submitting your self-assessment tax returns.

See also: How to Find Your Personal HMRC UTR Number

Where do I need to display my Company Registration Number?

Companies House automatically issues your CRN when you set up a limited company. You do not need to go through a separate process to obtain it.

Once your new limited company or Limited Liability Partnership (LLP) is successfully registered, the CRN will be included in your incorporation certificate. If you register online, you will receive a digital certificate containing the CRN. For those who set up their company via a paper application, the CRN will appear on the paper certificate sent to you by post.

See also: Advantages of LLPs

Where do I need to display my company registration number?

By law, you must display your limited company’s registration number (CRN) on all official company stationery, including:

- Letterheads

- Emails

- Invoices

- Receipts

- Website and Online Content

- Order Forms

What is the format of a company registration number for a partnership?

A CRN can take several forms depending on the jurisdiction of your company formation or the type of company you incorporate. See the table below for details.

Jurisdiction of incorporation |

Company Type |

Description |

Example |

|---|---|---|---|

England and Wales |

Limited Company |

An eight - digits that start with 0 or 1 |

01234567 |

LLP |

Alphanumeric comprises a two-letter “OC” prefix followed by six numbers. |

OC121212 |

|

LP |

Alphanumeric comprises a two-letter “LP” prefix followed by six numbers. |

LP222222 |

|

Northern Ireland |

Older (pre-partition) companies |

Alphanumeric comprises a two-letter “NI” prefix followed by six numbers |

NI1212121 |

Limited company (post-partition) |

Alphanumeric comprises a two-letter “OR” prefix followed by six numbers. |

R0333333 |

|

LLP |

Alphanumeric comprises a two-letter “NC” prefix followed by six numbers. |

*NC123456 |

|

LP |

Alphanumeric comprises a two-letter “NL” prefix followed by six numbers. |

NL444444 |

|

Scotland |

Limited Company |

Alphanumeric comprises a two-letter “SC” prefix followed by six numbers. |

SC555555 |

LLP |

Alphanumeric comprises a two-letter “SO” prefix followed by six numbers. |

SO888888 |

|

LP |

Alphanumeric comprises a two-letter “SL” prefix followed by six numbers. |

SL111111 |

🛈 Info

Your company number should not be confused with:

- Company UTR number, a 10-digit identifier (e.g. 0123456789), also known as a 'tax number' or 'tax reference,' is issued by HMRC for tax purposes.

- VAT Number, an alphanumeric with the prefix “GB,” followed by nine numbers (e.g., GB123456789), is issued by HMRC for VAT registration.

- PAYE reference number or Employer Registration Number (ERN), an alphanumeric number, consists of a three-digit number followed by a forward slash and a mix of letters and numbers (e.g. 123/AB456). It's issued by HMRC when an employer registers for Pay As You Earn (PAYE).

- Company Authentication Code a six-digit alphanumeric code issued by Companies House to limited companies. It serves as an electronic signature during digital filings.

- Companies House Standard Industrial Classification (SIC) code, assigned by Companies House, categorises a company's primary business activity.

read

Address line 1 - building suite or number and street name. Address Line 2 includes secondary address information like the box number, postal or ZIP code.

🔑 Key Highlights

- Address systems provide essential information to ensure mail is accurately delivered to the correct recipient. Proper formatting is crucial for efficient mail handling and delivery.

- In the UK, "Address Line 1" typically includes the building number and street name, ensuring precise identification of the delivery location.

- For the US, "Address Line 1" includes the building number, street name, and street suffix (e.g., Street (St.), Avenue (Ave.), Boulevard (Blvd.)). This additional detail helps differentiate between similarly named streets.

- Address Line 2 is optional and typically used for additional information such as a PO Box, ZIP code, postal code, or other secondary details.

What goes in Address Line 1?

In the UK, Address Line 1 is the first line of an address form field and a key component that typically includes:

- Building Number: The unique number assigned to the property on a street. For example, "152 – 160 City Road" has the building number 152 – 160.

- Street Name: The name of the street where the property is located. In "152 – 160 City Road," the street name is City Road.

If a property has a registered building name, it can be used in place of the building number and should be followed by the street name on the next line. However, using a building number is generally recommended to avoid confusion during mail delivery. For clarity and precision, many people who include a building name also provide the building number and street address information.

A full UK address can look like -

| With Registered Building Name |

|---|

Address Line 1: Kemp House, 152 – 160, City Road. |

City: London. |

PostCode: EC1V 2NX. |

| Without just a building number |

Address Line 1: 128, City Road. |

City: London. |

PostCode: EC1V 2NX. |

In the US, Address Line 1 typically includes the following information:

- Building Number: The unique number assigned to a property.

- Street Name: The name of the street where the property is located.

- Street Suffix: The type of street, such as "St" for Street, "Ave" for Avenue, "Rd" for Road, etc.

- Additional Address Details: If Address Line 2 is not available, Address Line 1 can include apartment or suite numbers, such as "789 Pine Street, Apt 4B."

Example:

Building Name: The White House

Address Line 1: 1600 Pennsylvania Avenue, N.W.

Address Line 2: Washington, DC 20500

This structure ensures precise and accurate mail delivery, with Address Line 1 providing the essential location information.

See also: Correspondence Address Vs. Residential Address

What is address line 2?

Address Line 2 is an optional field that allows you to provide additional address details, such as apartment numbers, suite information, building names, or other specific location identifiers. While these details are especially useful for doorstep delivery services, they may not always be necessary during online checkout. Providing accurate information in this field ensures smooth deliveries and minimises errors.

Examples of details you can include in Address Line 2:

- Apartment number

- Suite number

- PO Box

- Room number

- Floor number

- Unit number

- Department number

Address Line 1 is often sufficient on its own, and adding Address Line 2 can confuse users who are unsure what information to provide, potentially impacting the user experience. However, there’s nothing wrong with including “address line 2” for complex addresses, as it provides a valuable option to ensure accurate delivery details.

How do I fill address line 1 and address line 2 fields?

The format may vary by destination country, but generally, address line 1 and 2 contain the following information:

- Address Line 1: This line contains the building number, street name, and suffix (e.g., "123 Elm Street, Apt 4B" in the US) and specifies the exact property location.

- Address Line 2: Includes the city, state (for the US), and postal or zip code (e.g., "New York, NY 10001").

Always confirm the specific addressing format the destination country requires for accurate mail delivery.

What is the importance of address line 1?

Address Line 1 is the primary component of an address, specifying the exact location where mail should be delivered, such as the house number, street number, and any applicable suffix. Address Line 2 provides additional details, such as apartment numbers or secondary location information, to further qualify Address Line 1. Together, they ensure accurate and efficient mail delivery.

What is a full postal address example?

A full postal address includes more than just a PO Box; it also contains the street name, building number, and any other relevant details that enable precise physical delivery of parcels. This ensures accurate and reliable delivery to the intended location.

How do I use the address field while filling out online forms and applications?

The address field is divided into specific components to ensure accurate delivery when filling out online forms. Here's how to use each field effectively:

Address Line 1:

- Include the building number and street name.

- If you are in the US, include the street suffice.

UK example: 152 – 160 City Road.

US example: 123 Elm Street, Apt 4B.

- Address Line 2:

- Use this optional field for additional information such as apartment numbers, suite details, PO Boxes, or other secondary location identifiers.

- Example: "Suite 101" or "PO Box 456."

- City and Postcode/ZIP Code:

- Ensure you include the correct city and postal code.

- UK example: London, EC1V 2NX.

- US example: New York, NY 10001.

- Confirm Address Format:

- Verify the specific address format required by the destination country to avoid errors.

Providing complete and accurate information in these fields ensures efficient and precise delivery of mail or parcels.

City, state and zip code go to which address line?

When filling out address details, the city, state, and ZIP/postal code should not go in Address Line 1 or 2. Instead, they are typically entered in separate fields provided below these lines in online forms.

read

Are you looking to register your company? Learn how to get your certificate of incorporation, including the online application and replacement procedure.

🔑 Key Highlights

- A certificate of incorporation is conclusive evidence that your company has been duly registered with Companies House.

- You can call Companies House or use their search service to get a hard copy of your certificate.

Certificate of Incorporation Defined

A Certificate of Incorporation proves that your company has been officially registered at Companies House under the Companies Act and is recognised as a legal entity in the UK. It signifies that your business is now separate and distinct from its shareholders and directors, operating independently under the law.

Who needs a certificate of incorporation UK?

A certificate of Incorporation is essential for various entities and individuals registering a company in the UK. Here's a breakdown of who needs one:

- Entrepreneurs registering a limited company by shares — Whether establishing a public or private company, entrepreneurs seeking to set up a business structure where ownership is divided into shares require a registration certificate.

- Individuals establishing charitable organisations — Individuals or groups intending to establish charitable organisations with limited liability protection in the UK that operate under a company limited by guarantee structure also require a certificate.

- Partners Forming Limited Liability Partnerships (LLPs) or Limited Partnerships (LPs)—Partners seeking to enjoy limited liability protection can opt to form LLPs or LPs. In both cases, obtaining a certificate of incorporation is necessary to formalise the registration process and establish the legal entity's existence.

The certificate is official proof of the company's legal incorporation and is essential for conducting business activities and fulfilling legal requirements.

See also: What does limited liability mean?

Which company details are found in a certificate of incorporation?

Once Companies House has approved your registration application, you will find the following details in an incorporation certificate.

- The type of company such as a private or public company, LLP or another legal entity structure.

- The registration number uniquely identifies the company and depends on the entity type. For example, a partnership will have a partnership number, while a private limited company will have a company registration number (CRN).

- The certificate indicates the official date of incorporation or registration.

- The full legal name under which the company is registered is provided in the certificate.

- Registrar information may be from Companies House in England and Wales, Companies House Scotland, or Companies House Northern Ireland.

- Depending on the jurisdiction, formation jurisdiction may be Cardiff, Edinburgh, or Belfast.

- Relevant legislation or laws under which the company is formed provide the legal context for its establishment, e.g., the Companies Act (2006) or the Limited Liability Partnership Act (2000)

Company Name Requirements for a New Company in the UK

When registering a new company in the UK, the name displayed on your certificate of incorporation must adhere to specific criteria set by Companies House. To ensure approval, your company name must meet the following requirements:

- Uniqueness — The proposed name must not closely resemble an existing company name, helping to avoid confusion among consumers and stakeholders.

- Exclude official terms — Avoid incorporating terms like "Royal" or "Government" to imply an association with any local or national UK government agency, as these terms require official authorisation.

- Avoid sensitive words — Exercise caution when using sensitive words like "Chartered" or "Accredited," ensuring proper authorisation is obtained before inclusion.

- Appropriateness—The name should be appropriate and not offensive, inappropriate, or likely to cause harm, maintaining professionalism and respectability.

- Compliance with legal standards — Ensure the name does not suggest criminal activities contrary to the public interest, adhering to legal standards and ethical principles.

How to Register Your Company With Companies House

Here is what you need to form your company directly with Companies House:

- Company name — Choose an appropriate name for your company. Ensure it's unique and complies with Companies House regulations.

- Officer details — Provide information about the company directors and persons with significant control (PSCs), including their names, addresses, and other relevant particulars.

- A registered office address — The official address for receiving statutory mail.

- Memorandum and articles of association—Outline the subscribers' initial commitment to establish a company and rules for internal management, respectively.

- Correspondence address for the officers — For receiving statutory letters and legal notices relevant to their role.

- Share structure — Determine your company's share structure, including the number of shares and their respective values.

- Standard industrial classification (SIC) code — Identify the appropriate SIC code that best describes your company's primary activities.

Once you have these details ready, you can initiate the registration process. The cost for setting up a limited company directly with Companies House is £12, and the process typically takes around 12 hours to complete.

To begin your company formation journey, visit the following link:

https://www.gov.uk/limited-company-formation/register-your-company

Here's how you can take advantage of our free company formation offer:

- Obtain privacy addresses – Protect your company officials, including directors, persons with significant control, and shareholders. Maintain confidentiality and protect personal information.

- Invest in virtual office packages — Our comprehensive virtual office package is designed to provide a professional business address, mail handling services, and more.

- Choose resident or non-resident formation packages — Choose from our range of resident or non-resident formation packages, which include complimentary UK company setup addresses and secretarial services.

With Your Virtual Office London, you can streamline the company formation process and focus on driving your business forward. Experience hassle-free registrations and comprehensive support every step of the way.

Further insights on incorporating a company: Register & Thrive: UK Company Formation Made Simple

How to Get Another Certificate if You Lose One

Always keep your certificate of registration in a safe and easily accessible place so you can quickly produce it when needed.

However, if you lose your original certificate of incorporation. You can get a copy of the certificate online since Companies House service provides free access to company details and filings through the following steps:

- Visit the Find and Update company information service at https://find-and-update.company-information.service.gov.uk/

- Enter your company number or name in the search box.

- Select your company from the list.

- Click on "Filing history."

- Scroll down and choose "View PDF" next to Incorporation (you may need to navigate to older pages).

- Download a PDF copy of your certificate.

You can obtain a certified copy of your certificate of incorporation by calling Companies House on 0303 1234 500 and providing the company's CRN. The standard service costs £15.00, while the same-day service costs £50.00. Digital copies can also be requested via email.

How to Get a Certificate of Incorporation Via Companies House Directly

Companies House sends a company’s certificate of incorporation to the company in the following ways:

- By post — You’ll be sent a certificate of incorporation through the post to the company's registered office address as Companies House approves your application.

- Digital certificate —You can also download a digital copy of your certificate from the Companies House website by searching for a company and accessing its filing history.

- Ordering a certified copy—If a company has misplaced its original certificate, it can order a ‘printed certificate of incorporation’ from the Companies House by calling its contact centre. The standard service cost is £15, and the certified copy is delivered within 4 working days.

In summary, Companies House primarily delivers the certificate of incorporation by sending the original printed version to the company's registered office through the post. Companies can also obtain digital or certified copies of the certificate as needed.

How to Get a New Certificate if You Change Your Company Name

After your company is incorporated, tell Companies House when you want to change its name. You'll be issued a Certificate of Incorporation on Change of Name via email, reflecting the new company name while retaining all other details, such as the company registration number and incorporation date, identical to those on the original certificate.

read

How to sign in or set up your Government Gateway online service account to access government services and insights on GOV.UK One Login.

🔑 Key Insights

- Government Gateway is a platform that allows UK residents to register for UK HMRC services online.

- There are three types of accounts: individual, through which you can access your personal tax details and file your self-assessment; organisation accounts, for access to business tax services; and agent accounts, through which institutions access HMRC services on behalf of their clients.

- Though the Government Gateway is still in use, HMRC is introducing the user-friendly GOV.UK One Login starting Spring 2024. The authority will guide users through the transition process, making sign in or set up procedures straightforward.

What is the Government Gateway?

Government Gateway is a UK online platform designed to help residents register for HMRC e-services. With this platform, individuals can manage their personal tax accounts and file self assessment documents, while business owners can handle their business tax accounts efficiently. Additionally, agents can use the tax portal to access services for their clients. Launched in 2001, this system replaced old paper-based submissions with digital versions, making various tax-related activities more streamlined and convenient for everyone.

What HMRC online services are available through the Gateway system?

You can access all HMRC services using your online service account, including —

- Personal tax account services such as – some text

- Filing for self assessment returns;

- Seeing what you owe, paying your individual tax bill; and

- Childcare services, including making child benefit claims, free childcare update information or other related functions.

- Business tax accounts like - some text

- Filing corporation tax;

- Register for VAT, submit your returns, and make payments;

- Amend your business related VAT details;

- Enrol for Making Tax Digital (MTD) for VAT;

- PAYE for employers; and

- Manage Construction Industry Scheme (CIS) obligations.

- Pension-related services, including accessing pension schemes

- Services for Charities, including claiming gift aid.

Other state departments also leverage the platform to facilitate access to their services. These include –

- Accessing DAERA online services provided by the Department of Agriculture, Environment and Rural Affairs

- Department for Work and Pensions (DWP), responsible for various benefits and pension services.

- For vehicle tax and driving license services provided by the Driver and Vehicle Licensing Agency (DVLA)

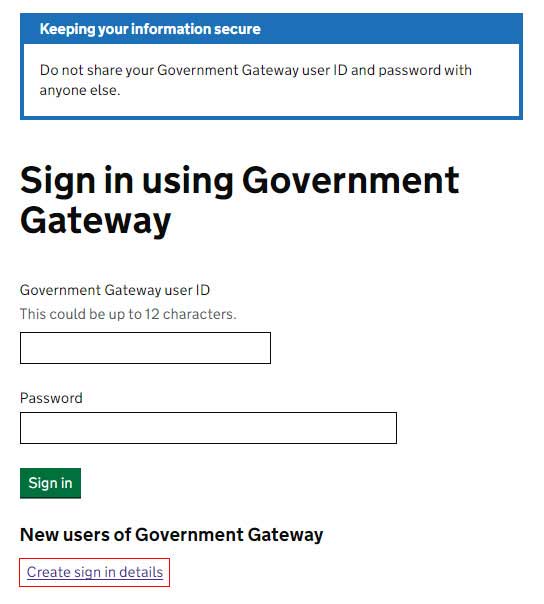

How do I get a Government Gateway user ID and password to sign in, and what information do I need to provide?

To create your tax profile on a computer, follow these steps:

- Open your web browser and go to the sign-in or set-up page: https://www.gov.uk/log-in-register-hmrc-online-services

- Click on the green "Sign In" button, which will lead you to: https://www.access.service.gov.uk/login/signin/creds

- Scroll to the bottom of the page and click on "Create sign in details."

- Enter your email address, where a confirmation code will be sent.

- Check your email for the confirmation code and enter it to confirm your email.

- Once your email is confirmed, enter your full name.

- Create a password.

- Provide a recovery word in case you forget your password.

- Your Government Gateway ID will be created.

- Set up additional security by opting to receive an access code every time you log in.

- Complete the identity verification process using one of the following documents: UK ID, P60, payslip, tax credit, or voice ID.

- Enter your personal details, including your first and last name, National Insurance number, and date of birth.

- Provide the required information from the selected authentication document. For example, if you choose a payslip, you must provide your national insurance, PAYE, and passport details.

- Once your identity is confirmed, you can start using your account.

When will HMRC start replacing Government Gateway accounts with the One Login?

From May 2024, HMRC began rolling out GOV.UK One Login for the new individual taxpayer. The rollout of agents and companies will be communicated later. According to HMRC's latest reports, over 1.5 million people are already using the platform.

As of 2 August 2024, the services that are operational and available to users include —

- HM Armed Forces Veteran Card application

- vehicle operator licence application

- register as a social worker in England

- apprenticeship assessment service

- apprenticeship provider and assessment register (APAR)

- check if a health condition affects your driving

- claim compensation if you were the victim of a violent crime

- connect families to support

- early years child development training

- find an apprenticeship in England

- find and apply for a grant

- find and use an API from the Department for Education

- find a UK market conformity assessment body

- GOV.UK email subscriptions

- manage apprenticeships

- manage family support services and accounts

- manage fishing permits an d catch returns in Wales

- modern slavery statement registry

- Ofqual subject matter specialist account

- renew your short-term medical driving licence

- request a basic DBS check

- sign your mortgage deed

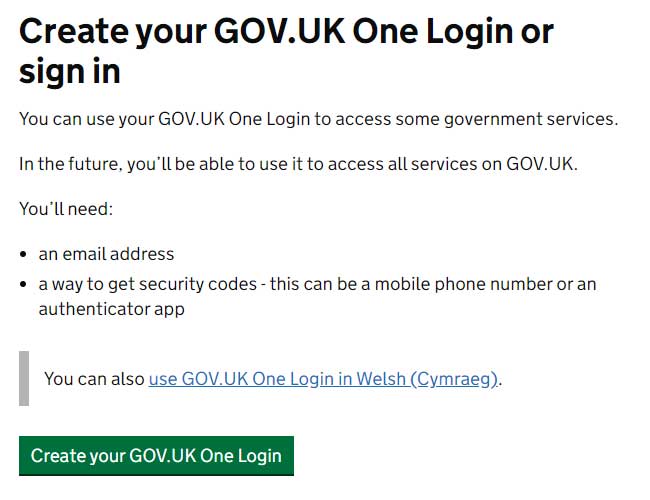

How do I access my GOV.UK One Log in online account?

To access your online tax portal, follow the steps below -

- Go to the official sign in page - https://signin.account.gov.uk/sign-in-or-create

- Click ‘Create your GOV.UK One Log in’.

- To access an existing account, click on sign in below the green button.

- You will be required to provide your email address, where an email confirmation code will be sent.

- Check your email for the confirmation code and enter it to confirm your email.

- Once your email is confirmed, enter your full name.

- Create a password.

- Provide a recovery word in case you forget your password.

- Your GOV.UK One Login ID will be created.

Over time, One Login will replace all other ways to sign in to services on GOV.UK, including Government Gateway.

How do you verify your identity for One Login?

As the name suggests, the UK government will provide all government digital services through one login system. The user will only be taken through identity verification once, and thereafter access multiple services without needing additional verification.

To verify your identity for One Login using the GOV.UK ID Check app, follow these steps:

- Start on the Government Service:

Begin on the government service you are trying to access. You’ll be guided to the app when necessary. - Avail an appropriate photo ID:

You can use a UK photocard driving licence, UK passport, non-UK passport with a biometric chip, UK biometric residence permit (BRP), UK biometric residence card (BRC), or UK Frontier Worker permit (FWP). - Download the App:

- For iPhone users, ensure your device runs iOS 14 or higher. An iPhone 6s or newer is needed for a UK driving licence, and an iPhone 7 or newer for other photo IDs.

- For Android users, ensure your device runs Android 10 or higher.

- Search for the app in the App Store or Google Play if you are on your phone.

- If using a computer or tablet, scan the QR code displayed to download the app.

- Ensure you’re not using private browsing or incognito mode in your web browser.

- Link the GOV.UK ID Check app to GOV.UK service you need:

You will need to link the two together to help determine whether you are the same person who signed in to a government service with One Login in step 1.

- Tap ‘Continue’ when you open the app and accept any sign in prompts.

- On the ‘Link this app to GOV.UK’ screen, tap the ‘Link app to continue' button.

- Scan Your Photo ID:

- For a UK driving licence, place it on a dark, matte background to avoid glare. Place the entire licence inside the white frame, hold it steadily, and the app will take an automatic photo.

- Ensure your passport has a biometric chip. Take a photo of the passport, scan the chip, and scan your face using your phone.

- For a BRP, take a photo of the BRP, scan the chip, and scan your face using your phone.

- Face Scanning:

Use your phone’s front-facing camera, align your face with the oval on the screen, look straight ahead, and keep still during the scan.

What are the benefits or changes expected with the introduction of One Login?

According to the government, One Log in will change how people access government services by providing a single, unified platform for all interactions.

Here are three key advantages that make this streamlined system a game-changer for users and the government.

- Simplified Access: One Login streamlines the process of accessing government services by requiring just one account, one username and password, and one identity check. This eliminates the need for multiple accounts and reduces the hassle of remembering different sign in credentials.

- Cost and Time Efficiency: Consolidating the various sign in methods into a single platform will save over £700 million and significantly reduce the time and effort required for both users and government departments. Currently, there are around 191 different ways to set up accounts and 44 different sign-in methods, which are costly and inefficient.

- Wide Adoption and Ease of Use: By 2025, over 100 public services, covering most central government services, will use One Login. The One Login app, which allows users to quickly, easily, and securely verify their identity using their smartphone, has already been downloaded two million times and successfully used by over 1.5 million users.

When will HMRC begin migrating users to One Login?

HMRC began migrating users to One Login in Spring 2024. Initially, they focused on new users without a government service account and some existing customers. At the same time, they are onboarding government agencies and services, raising awareness about the new system and highlighting its benefits in streamlining processes for service providers.

How will the migration process be carried out for Gateway users?

HMRC still needs to detail the exact migration process. Only new taxpayers can access the service while existing users are asked to wait until later. Over the next few months, individuals, businesses, and agents will likely receive prompts to complete identity verification on One Login. The migration will be gradual, with increasing volumes over time, and is expected to be fully completed by the end of the 2024/2025 tax year, which is March 2025. Users may also proactively request to use the service during this period.

Contact details for Government Gateway

For business or personal tax account queries, please contact HMRC at 0300 200 3600. If you are calling from outside the UK, use +44 161 930 8445. Their phone lines are open Monday through Friday from 8 a.m. to 6 p.m. and are closed on weekends and bank holidays.

read

Seeking to register your company in the UK? Get the latest insights for successful UK company formation with Companies House.

🔑 Key Highlights

- A sole trader is the simplest form of a UK business structure. It suits mostly freelancers and solo entrepreneurs who prefer autonomy and direct control over their business operations and decisions.

- Individuals in an LLP are not required to file a company tax return. However, untaxed profits are distributed, and the members pay via self assessment returns.

- To register a company in the United Kingdom requires at least one director and shareholder to become a separate legal entity with distinct rights.

- A UK-resident company is registered in the UK and is liable to pay UK tax. It does not require a UK resident director but must be registered at Companies House to a UK address.

Whether you live in the UK or are a foreigner seeking to do business in the UK without living here, there are various ways to set up a company and make yourself official. Fortunately, you can form a new company in less than one working day. Determine your goals and the appropriate company structure to get started.

How to Register a Company in the UK (Company Structure and Formation Guide)

There are three basic formats a UK company registration can take –

- Sole trader;

- UK limited company formation, which includes -

- Private & Public Limited Companies (LTD & PLC);

- Limited by Guarantee Company (CLG);

- Limited Liability Partnerships (LLP);

- General Partnerships.

Register Your Company Today!

All of them are suitable for different business types, so choosing the right one is the first step towards registering a company.

Register as a Sole Trader

Also known as a sole proprietorship, it is a type of business with one owner. You can trade under your name or use a business name as a sole trader. It is the simplest business structure in the UK and may suit freelancers or other solo entrepreneurs.

You can register as a sole trader if you’ve earned more than £1,000 from self-employment in the last tax year - (6 April of the last year to 5 April of the current year). Register by 5 October of your second tax year of business.

To register as a sole trader, enroll for self-assessment and class 2 national insurance through their business tax account if your profits exceed the £6,725 threshold. You’ll need a government gateway ID and password to access the account.

However, registering for self-assessment is different from registering a sole proprietorship. It allows you to report your income, including self-employment income, to HMRC.

Set Up a Limited Company In the UK

In most cases, registering a company requires at least one director and shareholder for the business to become a separate legal entity with distinct rights. You can be a sole company director and shareholder of your own business. You can also add more directors and shareholders in the future if you decide to expand your company.

Compared to other company incorporation UK formats, a limited liability company has more compliance requirements, which come with added benefits, including protecting your personal finances in case the business encounters financial difficulties or fails. If you want to take the hard work out of officially forming your business, consider using our company set-up service and save yourself the extra effort. It is a simple two-step method where you order online, and we contact you for the necessary information to swiftly and securely register your company with Companies House.

11 Defining Features of Limited Companies

| Features | Public Limited Company (PLC) | Private Limited Company (LTD) | Limited By Guarantee Company (CLG) | Limited Liability Partnership (LLP) |

|---|---|---|---|---|

Limited Liability |

||||

Separate Legal Entity |

||||

Minimum Number of Shareholders |

2 |

1 |

1 member |

2 members (An LLP does not have shares or shareholders its a constitution of members) |

Minimum Number of Directors |

2 |

1 |

1 member |

2 members (An LLP does not have a director, its a constitution of members) |

Transfer of Ownership |

Can be publicly traded |

Private |

Private |

Procedure for the transfer of interests indicated in the partnership agreement |

Annual Confirmation Statement |

||||

Conversion |

Can convert to an LTD |

Can convert to a PLC |

N/A |

N/A |

Minimum Share Capital |

£50,000 (with at least 25% paid up) |

£1 |

No specific |

minimum |

Management Structure |

Board of directors |

Board of directors |

Board of directors |

The designated members handle statutory obligations |

User |

Suitable for large companies |

Common for small to medium companies |

Common for small to medium companies |

Professional service firms (eg. accounts and law firms) |

Types of UK LTD companies you can form include —

Limited Liability Partnerships (LLPs)

A limited liability partnership has at least two members (people or a company known as a corporate member) coming together to own and run the business jointly. Even though all the members have equal rights over the business, the law requires that at least two of them be designated as responsible for ensuring compliance with statutory requirements.

The partners must register for self-assessment since the LLP does not pay corporation tax, but each member is taxed on their share of profits as a self-employed individual. However, the members are not liable for debts if the business fails to pay.

To register, you’ll need an acceptable business name, a registered address in which your principal place of business will be publicly available, two designated members, and an agreement that outlines how the LLP will be run. Once you have the requirements, you can register your LLP with Company House. Leverage Your Virtual Office London LLP registration service for a swift and affordable process.

Set Up a Private Limited Company (Limited By Shares of Guarantee)

A company must either be limited by guarantee (CLG) or shares (LTD). An ltd is a profit-making business owned by shareholders with certain rights. The corporation is divided into shares, each assigned a nominal value, which reflects the initial face value of the shares, which may or may not align with the actual market value.

CLG, on the other hand, is for a non-profit, such as a social enterprise, charity, association, or club, owned by members who act as guarantors of the company's liabilities, and each member undertakes to contribute an amount specified in the articles in the event of insolvency or the winding up of the entity. It does not have shares or shareholders.

To set up an LTD company online, you’ll need to choose a name according to Companies House rules. Next, you will need to appoint the company officers, which typically include directors, with the option of appointing a company secretary. You will also be required to give the names of the shareholders, who may also be company directors. Articles and memorandum of association are essential because they document how you intend to run the entity. Lastly, Companies House requires that you register an official address and choose a SIC code that identifies what your company does.

Setting up a UK CLG requires that you submit the following company documents —

- Check that your preferred company name is available;

- Have at least one guarantor (individual or corporate body) and director;

- A constitution that contains elements of articles and memorandum of association;

- A registered office address in the UK that will be publicly available;

- Names of the persons with significant control;

- Statement of compliance that -

- Outlines the nominal amount (often a small sum, such as £1) that each subscriber will pay as their guarantee;

- The statement of guarantee that details the circumstances under which a guarantor will be required to pay their guarantee and

- A SIC code.

How to Choose Your Company Name

Once you decide to register a new business, use the checklist below to get the name right —

- Confirm that the name is not too similar or identical to an existing company name.

- Your preferred company name should not suggest any connection to the UK government. Avoid using words such as “Royal,” “Her Majesty,” or “Crown.”

- The name should not be offensive or inappropriate in any way.

- It should not suggest criminal activity or any undertaking contrary to the interest of the public.

- Unless you have relevant permission, avoid using words like “Chartered” or “Architects” that are likely to mislead the public as to the nature of your business or credentials.

Read also: Top 21 Best Small Business Apps to Manage Your Daily Operations

Register Your Company Today!

Contact Your Virtual Office London, UK's top rated company formation agent, if you need to register a new company. We offer a comprehensive set of company formation packages, which include everything you need to get your company up and running.

Other extras included in the package above are —

- Fast Online Formation

- UTR Number

- Digital Certificate of Incorporation

- Digital Articles of Association

- Digital Share Certificates

- £25 Cashback with Wix

- Bank Referral

- Free .co.uk Domain

- Free Accountant Introduction

- Fully Compliant with AML and KYC Regulations

See also: Your HMRC UTR Number Explained

Form a limited company with us. Call our team at +44 (0) 207 566 3939 or email us at info@capital-office.co.uk, and one of our formation experts will contact you to get the relevant company details and handle the company formation process for you. Depending on the Companies House workload, online company registration can take up to 6 working hours.

FAQs

How much money is required to register a UK company with Companies House?

Register a UK company and start your journey right with a bundled package of just £39.99, which includes a UK registered office address, a free .co.uk domain, and an accountant introduction. We provide exceptional value for those keen on commencing their business without additional office space expenses and initial staffing requirements.

See also: Directors Service Address Vs. Registered Office Address Service

Can anyone register a new company in the UK?

Registering a new company for UK and non-UK residents takes up to 6 hours to form a company. All you need to do is determine the type of company you want to establish, think through an appropriate business name and contact us. We will help you put together all the necessary documents you need to set up an LTD.

How to register a holding company in the UK?

In the UK, the term ‘holding company’ is used to describe a company that holds the shares of other companies. A common way to register a holding company is to incorporate it as an LTD through the following steps:

- Think through a unique name for you and register it with Companies House. Until 2015, using the word “holding” or “holdings” in a company name was considered sensitive by Companies House, but it is now acceptable.

- Register an official business address and select an appropriate SIC code.

- Appoint directors and a company secretary. You must appoint a director, but you do not have to appoint a company secretary.

- Identify people with significant control (PSC) over your company—for example, anyone with voting rights or more than 25% of the shares.

- Prepare a memorandum and articles of association describing the company will run.

- Form your company.

After you’ve set up the holding company, transfer the ownership of your subsidiaries' shares and assets to it.

Can I own a business in the UK as a foreigner or non-UK resident living outside of the UK?

Yes, foreigners and non-residents can open a company in the United Kingdom without needing a VISA. There are no restrictions based on nationality. However, you’ll need to comply with the following legal and administrative requirements before you are cleared to start.

- Choose a proper business structure that best fits your business goals;

- Register your business with Companies House to a UK address; and

- Get the necessary permits or licenses.

Once your business is registered, please note the following —

- The corporation registered to a non-resident is liable for UK tax obligations.

- A UK resident director is not a mandatory requirement, but it is recommended for operational convenience.

- While not legally required, having a UK bank account is advisable to enhance business credibility.

- You can use a family or friend's address as your registered office or opt for a central London virtual address for added privacy.

Do I need a business bank account during the company registration process?

No. You do not need to open a business bank account, but you’ll likely find it impossible to operate without one. We understand that most British high-street banks can make it difficult for the new entrepreneur to open an account with company credit checks and multiple other requirements that new businesses cannot fulfil.

However, we’ve carefully selected partners with products suitable for our clients. As you set up your new business with us, we will recommend a few banks to consider. Whether you choose a Barclays Business Account or a Card One Business Account from our curated list, we ensure a seamless process to meet your financial needs.

What are the pros and cons of working with a simple company formation agent?

A company incorporation agent helps new businesses with online company formation and registration services. But with Your Virtual Office London, we go the extra mile and ensure your process is simple, seamless, and affordable. If you choose to form your company limited by share or guarantee with us, take the time to understand your goals, risk tolerance and incentives. With this understanding, Your Virtual Office London will advise you on the most suitable company structure and expedite your process by working with you to submit a company application without error.

There are no downsides to working with us!

What company documents do I need during simple company registration?

To register your company, you’ll need to submit the following documents —

-

IN01 form, which should contain the following details –

-

Proposed name

-

Registered office address for your business

-

Details of directors and shareholders

-

Share capital information

-

Information of the persons with significant control

-

-

Memorandum of association, which outlines the following details —

-

Company name

-

Type of company and its purpose

-

Name and signature of subscribers

-

Liability of the members

-

-

Articles of association

-

Management details, which may include the rights and responsibilities of the director, voting rights and board meetings

-

Decision-making processes

-

Classes and rights of shares

-

General meetings

-

Miscellaneous factors depending on the dynamics of your company

-

What documents do I receive after new business registration?

Once your new limited company is registered, you’ll receive the following documents —

- Certificate of incorporation, which includes your company number;

- Official memorandum and articles association; and

- Share certificates.

read

Discover how to change your UK limited company registered office address at Companies House using form AD01 or WebFiling.

🔑 Key Highlights

- You can change your registered office address anytime throughout the lifetime of your company.

- With the recently enacted Economic Crime and Corporate Transparency Act, your registered address must be a physical address in the same country where the company is registered, not a PO box address.

- Statutory letters from government agencies such as the Office of National Statistics, courts, Companies House, and HMRC are sent to the registered office address.

How to Change a Company Address (Online and With Form AD01)

You are responsible for keeping your company information as held by Companies House up to date. But before you proceed to change, ensure that the new address remains within the same part of the UK where your company is registered – England and Wales, Scotland, or Northern Ireland.

Change your company address online using your WebFiling credentials (email address and password).

Watch the video below for more information.

A video guide on how to change your director or company address registered with Companies House

You can also change your details by post using form AD01

You’ll need the following details to fill out the form –

- Company name

- Company registration number

- Details of the new address

- Presenter information (details of the person filling out the form)

To avoid penalties, you must update your company information held at Companies House within 14 days of the change.

Once your change of address becomes effective, Companies House will inform HMRC.

FAQ

What is a registered office address?

Companies House, HMRC, and other government agencies use a registered office address to send official mail. You can use your home or business address, but note that Companies House will no longer accept a P.O. Box.

Also known as a service address, the registered office address is the official address of your Company. As far as mail is concerned, it is the point of contact between your private limited company and the government.

Before you register your company, be sure to have it in place.

Can I use my residential address as my company’s registered office address?

Yes. You can use your home address as your registered office address. However, since the address will be publicly available on the Companies House register, you may get unwanted mail and visitors, exposing you to privacy and security challenges.

Instead, consider working with a virtual office address service like ours and acquire a prestigious central London address that elevates your brand image.

What is the difference between a trading address and a registered office address?

A trading address is where you are carrying out your business activities. If you have a professional business premise, you can register your trading address as the registered office address. However, you may have to deal with uninvited visitors since this information will be available on the Companies House public register.

Furthermore, with your landlord's permission, you can provide your home address as your registered address. Yet, this option exposes you to privacy violations and junk mail.

Do I or a company representative need to be available at the trading address to receive correspondence?

You do not need to trade from your registered office service location or have any company representative present. However, you need someone at the address to receive, sign, and confirm receipt of the government mail sent to the business. Such an individual can be anybody, including the staff at a virtual office.

It ensures that official documents, notices, or communications are properly handled and acknowledged by someone at the specified address. By fulfilling this requirement, you demonstrate that you have a reliable point of contact for regulatory or governmental entities, even if the business or company representative is not physically present at the trading address.

What are the key features of your registered address service?

As far as virtual office services are concerned, we are the best.

A registered office address is a legal requirement during company formation. Further, with the enactment of the Economic Crime and Corporate Transparency Act already established, companies have until March 2024 to switch to a physical address from a P.O. Box.

read

Explore profitable small business ideas to start in 2024! Discover how to start today, leveraging in-demand skills and addressing key market needs.

Looking to start a business in the UK? Consider this your essential guide to small business ideas that can significantly boost your finances while positively impacting your community. Whether you're considering a simple venture like a Virtual Assistant service or a more complex operation like market research or homecare services, we’ve got you covered with multiple business ideas to explore. Each section outlines the essential skills to help you assess your readiness, startup costs, and the ideal business structure.

Quick Tips for Starting a Small Business In the UK

Take time to sharpen your skills.

Explore the option of taking a skill enhancement course in an area that genuinely interests you. Alternatively, select a field where you're already actively trading or employed, as your experience can provide you with a strong foundation.

Review your employment contract to ensure that any non-compete clauses allow you to pursue a side hustle. This way, you can confidently grow your skills and explore new opportunities while staying aligned with your current commitments.

Try not to overplan before starting.

You don’t need to start with a detailed business plan. First, focus on understanding your ideas and goals, and let the details naturally develop as you gain more clarity and experience.

Establish a digital presence.

More than 90% of B2B and B2C purchases begin with an online search. By investing in a professional website, utilising social media, and implementing SEO, you can effectively attract and engage customers.

Don’t ignore tax requirements.

Overlooking tax obligations can lead to HMRC fines and legal challenges, harming your reputation. Staying on top of your taxes helps you avoid these issues and keeps your business running smoothly.

Prioritise customer experience.

Every profitable business provides exceptional customer service, which builds loyalty and inspires word-of-mouth referrals, the most effective form of marketing. When your customers have a great experience, they're more likely to share it with friends and family, helping your business grow through positive recommendations.

Don’t overlook financial management principles.

Managing your finances is crucial to keeping your business healthy. One key aspect is maintaining separate bank accounts for your business and personal finances. By practising sound financial management, you can prevent cash flow issues and position your business for long-term success.

Offer value-added services

Offering additional services that complement your main offerings helps you stand out and attract more customers, boosting your bottom line. By enhancing your value, you create more opportunities for growth and success.

High Skill Unique Business Ideas

As we delve deeper into the digital age, businesses' challenges are evolving at a pace that’s never been experienced before. The business ideas in this section stand out because they directly tackle the most pressing issues and rapidly growing concerns of our time. These ideas aren’t just limited to niche markets; they offer solutions essential for the growth and success of every organisation—and even individuals—in today’s digital landscape.

Cyber security

According to the UK Department for Science, Innovation, and Technology, many businesses and charities experience cyber attacks annually, illustrating the need for adequate protection. Cyber threats such as phishing, impersonation, and malware are not just technical nuisances—they pose serious financial risks and operational disruptions, particularly for medium and large organisations. As the frequency and impact of these breaches continue escalating, the demand for specialised cybersecurity services is rising.

Infographic on the Overview of UK Cybersecurity Breaches and Attacks In 2024.

The infographic below presents key statistics and insights on the most common types of cyber attacks, their impact on organisations, and the financial consequences of breaches. These growing threats highlight a significant business opportunity in the cybersecurity industry. By setting up a cybersecurity-focused business, you can play a crucial role in addressing these challenges, helping organisations protect their valuable data and maintain operations in an increasingly digital world.

This presents a unique and timely opportunity for entrepreneurs to establish cybersecurity-focused businesses that address these critical needs.

The possibilities are vast, from threat detection and vulnerability assessments to compliance consulting and incident response. Depending on their expertise and market demand, this variety allows business owners to target specific niches or provide comprehensive solutions.

Advantages of a Cybersecurity business

- A cybersecurity venture is one of the best business ideas to start in the UK because of its scalability. Entrepreneurs can start small, offering specialised services to a few clients, and gradually expand their offerings and client base as they gain experience and recognition in the market. This flexibility makes it attractive for those looking to grow a business over time.

- Unlike some industries vulnerable to economic fluctuations, cybersecurity remains a priority for businesses regardless of the economic climate. Protecting digital assets and sensitive data is essential, making cybersecurity services indispensable even during downturns. This resilience makes a cybersecurity business a stable and sustainable venture.

- Small—to medium-sized businesses and high-income charities often lack in-house cybersecurity expertise, making them prime targets for cybercriminals. A cybersecurity business can offer invaluable services that protect these organisations from potentially catastrophic breaches by focusing on these markets.

- Beyond the financial and operational benefits, running a cybersecurity business carries an ethical responsibility. By helping to safeguard sensitive data and protect online communities, your company contributes to a safer digital environment. This moral dimension adds value to your services and strengthens your reputation as a trustworthy provider.

How to Start a Cybersecurity company

The best registration format for your cybersecurity business is a UK limited company structure. Your business will deal with high-value clients, and an LTD provides the framework for professionalism. Furthermore, an LTD and a professional indemnity cover will protect you from personal liability and business obligations. You could also consider working with an LLP, allowing you to pair your skills with a strategic business partner.

Documents required to register a cyber security company in the UK include —

- For a limited liability company, you require an article and memorandum of association indicating a preferred company name, director and PSC details and the registered office and director addresses.

- Form LL IN01 for registering an LLP, through which you will provide the partner and PSC details and registered office address.

📋 Quick Summary

Skill requirements: Depending on your area of focus, pursuing one or more of the following certifications can significantly enhance your expertise:

Certified Ethical Hacker Certification: Specialises in ethical hacking and penetration testing.

GIAC Security Essentials Certification (GSEC): Validates foundational cybersecurity knowledge.

Certified Information Systems Security Professional (CISSP): Demonstrates expertise across multiple cybersecurity domains.

CompTIA Cybersecurity Analyst (CompTIA CySA+): Covers threat detection and response.

ISACA's Certified in the Governance of Enterprise IT (CGEIT): Specialises in IT governance and risk management.

ISACA’s Certified Information Security Manager (CISM): Emphasises managing and governing an enterprise’s information security program.

Average annual earnings: Potential income ranges from £100,000 to several million pounds annually, depending on the size, scope, and success of your business.