read

Companies House Identity Verification Launch Guide

The Economic Crime and Corporate Transparency Act requires voluntary identity verification for company officials at Companies House

🔑 Key Takeaways

- Companies House has introduced new identity verification measures to deter individuals from registering companies using false or obscure identities, helping to prevent fraud and improve corporate transparency in the UK.

- These measures are part of the Economic Crime and Corporate Transparency Act 2023 (ECCTA), which grants Companies House enhanced powers to improve the quality and reliability of the information held in the companies register.

- From autumn 2025, identity verification became mandatory for all newly appointed company directors and persons with significant control (PSCs).

- Existing directors and PSCs will enter a 12-month transitional period, during which identity verification remains voluntary. This transition is designed to minimise disruption while allowing businesses time to comply before enforcement begins in 2026.

The ECCTA introduced a wide range of reforms to the UK company law framework, aiming to improve transparency, reduce economic crime, and enhance the reliability of the Companies House register. Key changes include:

- Companies House Fee Increases: Effective 1 May 2024, Companies House increased the statutory fees for key services as shown in the sample below.

| Service | Before 1 May 2024 | After 1 May 2024 |

|---|---|---|

Digital Incorporation |

£12 |

£50 |

Same-Day Digital Incorporation |

£30 |

£78 |

Confirmation Statement Filing |

£13 |

£34 |

- Registered Office Address Requirement: Companies are now required to provide a complete physical address as their registered office. PO Boxes are no longer acceptable, ensuring greater traceability and accountability.

- Registration of Authorised Corporate Service Providers (ACSPs): From February 2025, any individual or organisation that undertakes anti-money laundering (AML) regulated activities on behalf of others, such as company formation agents or accountants, must register with Companies House as an Authorised Corporate Service Provider.

- Transparency for Limited Partnerships: Limited Partnerships must now meet enhanced reporting obligations, intended to bring them closer to limited company compliance requirements including:

- Filing a confirmation statement

- Providing a registered office address

- Disclosing partner details

- Statement of Lawful Purpose: All companies must now confirm that they are being formed for a lawful purpose at the point of incorporation. This is intended to deter misuse of company structures for illegal or misleading activities.

- Mandatory Identity Verification for Company Officers: Company directors, persons with significant control (PSCs), and individuals filing documents at Companies House must complete identity verification using a government-approved digital service.

- This will be mandatory from autumn 2025 for new appointments

- A voluntary phase began on 8 April 2025

- Existing officers have a 12-month transition window to comply by 2026

✅ Insight

When you registered your company with Your Company Formations, you completed identity checks in line with Anti-Money Laundering (AML) regulations and Companies Act requirements. However, under the new Economic Crime and Corporate Transparency Act 2023 (ECCTA), an additional identity verification is now required to comply with updated legislation.

Who needs to verify their identity with Companies House?

All individuals running, owning, or controlling a company in the UK must verify their identity with Companies House to prove they are who they claim to be. Identity verification must be completed at the point of incorporation for newly registered companies. However, existing companies have a 12-month transitional period to comply with the new requirements.

The following individuals and entities must complete identity verification:

- Company Directors

- Persons with Significant Control (PSCs)

- LLP Members and Designated Partners

- Anyone filing on behalf of a company, including secretaries or administrative personnel

- Authorised Corporate Service Providers (ACSPs) such as:

- Accountants

- Company formation agents

- Solicitors

- Governance professionals

- Other individuals conducting Anti-Money Laundering (AML) regulated activities on behalf of clients

These requirements are part of the broader reforms introduced under the Economic Crime and Corporate Transparency Act 2023, designed to improve the integrity of the Companies House register and prevent misuse of UK company structures.

Also read: How to set up a limited company online?

Is verifying your identity directly with Companies House using GOV.UK One Login possible?

Yes, you can verify your identity directly with Companies House through the GOV.UK One Login system. To do this, you will need one of the following biometric documents:

- A biometric passport (from any country)

- A UK photo driving licence (full or provisional)

- A UK biometric residence permit (BRP)

- A UK biometric residence card (BRC)

- A UK Frontier Worker permit (FWP)

The verification process is completed using the GOV.UK ID Check app uses facial recognition to match your photo with your identity document. Make sure your phone meets the minimum system requirements:

- iOS 14 or higher (for iPhone)

- Android 10 or higher

read

GOV.UK Government Gateway Online Service Account Explained

How to sign in or set up your Government Gateway online service account to access government services and insights on GOV.UK One Login.

🔑 Key Insights

- Government Gateway is a platform that allows UK residents to register for UK HMRC services online.

- There are three types of accounts: individual, through which you can access your personal tax details and file your self-assessment; organisation accounts, for access to business tax services; and agent accounts, through which institutions access HMRC services on behalf of their clients.

- Though the Government Gateway is still in use, HMRC is introducing the user-friendly GOV.UK One Login starting Spring 2024. The authority will guide users through the transition process, making sign in or set up procedures straightforward.

What is the Government Gateway?

Government Gateway is a UK online platform designed to help residents register for HMRC e-services. With this platform, individuals can manage their personal tax accounts and file self assessment documents, while business owners can handle their business tax accounts efficiently. Additionally, agents can use the tax portal to access services for their clients. Launched in 2001, this system replaced old paper-based submissions with digital versions, making various tax-related activities more streamlined and convenient for everyone.

What HMRC online services are available through the Gateway system?

You can access all HMRC services using your online service account, including —

- Personal tax account services such as – some text

- Filing for self assessment returns;

- Seeing what you owe, paying your individual tax bill; and

- Childcare services, including making child benefit claims, free childcare update information or other related functions.

- Business tax accounts like - some text

- Filing corporation tax;

- Register for VAT, submit your returns, and make payments;

- Amend your business related VAT details;

- Enrol for Making Tax Digital (MTD) for VAT;

- PAYE for employers; and

- Manage Construction Industry Scheme (CIS) obligations.

- Pension-related services, including accessing pension schemes

- Services for Charities, including claiming gift aid.

Other state departments also leverage the platform to facilitate access to their services. These include –

- Accessing DAERA online services provided by the Department of Agriculture, Environment and Rural Affairs

- Department for Work and Pensions (DWP), responsible for various benefits and pension services.

- For vehicle tax and driving license services provided by the Driver and Vehicle Licensing Agency (DVLA)

How do I get a Government Gateway user ID and password to sign in, and what information do I need to provide?

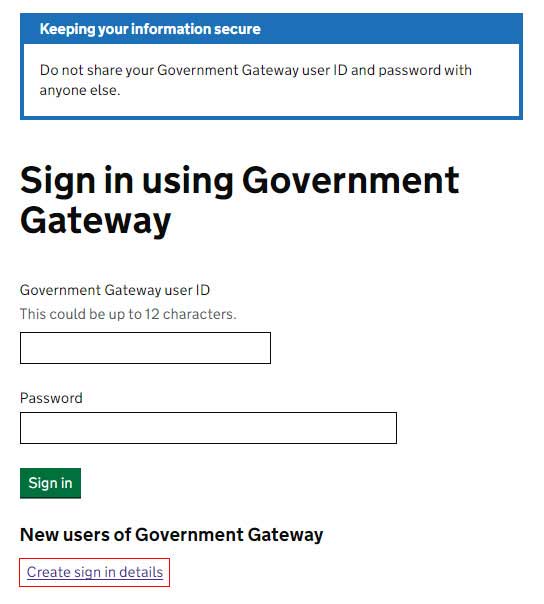

To create your tax profile on a computer, follow these steps:

- Open your web browser and go to the sign-in or set-up page: https://www.gov.uk/log-in-register-hmrc-online-services

- Click on the green "Sign In" button, which will lead you to: https://www.access.service.gov.uk/login/signin/creds

- Scroll to the bottom of the page and click on "Create sign in details."

- Enter your email address, where a confirmation code will be sent.

- Check your email for the confirmation code and enter it to confirm your email.

- Once your email is confirmed, enter your full name.

- Create a password.

- Provide a recovery word in case you forget your password.

- Your Government Gateway ID will be created.

- Set up additional security by opting to receive an access code every time you log in.

- Complete the identity verification process using one of the following documents: UK ID, P60, payslip, tax credit, or voice ID.

- Enter your personal details, including your first and last name, National Insurance number, and date of birth.

- Provide the required information from the selected authentication document. For example, if you choose a payslip, you must provide your national insurance, PAYE, and passport details.

- Once your identity is confirmed, you can start using your account.

When will HMRC start replacing Government Gateway accounts with the One Login?

From May 2024, HMRC began rolling out GOV.UK One Login for the new individual taxpayer. The rollout of agents and companies will be communicated later. According to HMRC's latest reports, over 1.5 million people are already using the platform.

As of 2 August 2024, the services that are operational and available to users include —

- HM Armed Forces Veteran Card application

- vehicle operator licence application

- register as a social worker in England

- apprenticeship assessment service

- apprenticeship provider and assessment register (APAR)

- check if a health condition affects your driving

- claim compensation if you were the victim of a violent crime

- connect families to support

- early years child development training

- find an apprenticeship in England

- find and apply for a grant

- find and use an API from the Department for Education

- find a UK market conformity assessment body

- GOV.UK email subscriptions

- manage apprenticeships

- manage family support services and accounts

- manage fishing permits an d catch returns in Wales

- modern slavery statement registry

- Ofqual subject matter specialist account

- renew your short-term medical driving licence

- request a basic DBS check

- sign your mortgage deed

How do I access my GOV.UK One Log in online account?

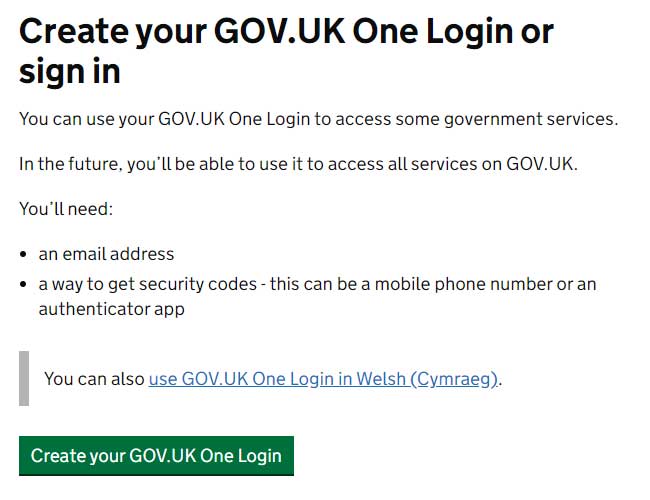

To access your online tax portal, follow the steps below -

- Go to the official sign in page - https://signin.account.gov.uk/sign-in-or-create

- Click ‘Create your GOV.UK One Log in’.

- To access an existing account, click on sign in below the green button.

- You will be required to provide your email address, where an email confirmation code will be sent.

- Check your email for the confirmation code and enter it to confirm your email.

- Once your email is confirmed, enter your full name.

- Create a password.

- Provide a recovery word in case you forget your password.

- Your GOV.UK One Login ID will be created.

Over time, One Login will replace all other ways to sign in to services on GOV.UK, including Government Gateway.

How do you verify your identity for One Login?

As the name suggests, the UK government will provide all government digital services through one login system. The user will only be taken through identity verification once, and thereafter access multiple services without needing additional verification.

To verify your identity for One Login using the GOV.UK ID Check app, follow these steps:

- Start on the Government Service:

Begin on the government service you are trying to access. You’ll be guided to the app when necessary. - Avail an appropriate photo ID:

You can use a UK photocard driving licence, UK passport, non-UK passport with a biometric chip, UK biometric residence permit (BRP), UK biometric residence card (BRC), or UK Frontier Worker permit (FWP). - Download the App:

- For iPhone users, ensure your device runs iOS 14 or higher. An iPhone 6s or newer is needed for a UK driving licence, and an iPhone 7 or newer for other photo IDs.

- For Android users, ensure your device runs Android 10 or higher.

- Search for the app in the App Store or Google Play if you are on your phone.

- If using a computer or tablet, scan the QR code displayed to download the app.

- Ensure you’re not using private browsing or incognito mode in your web browser.

- Link the GOV.UK ID Check app to GOV.UK service you need:

You will need to link the two together to help determine whether you are the same person who signed in to a government service with One Login in step 1.

- Tap ‘Continue’ when you open the app and accept any sign in prompts.

- On the ‘Link this app to GOV.UK’ screen, tap the ‘Link app to continue' button.

- Scan Your Photo ID:

- For a UK driving licence, place it on a dark, matte background to avoid glare. Place the entire licence inside the white frame, hold it steadily, and the app will take an automatic photo.

- Ensure your passport has a biometric chip. Take a photo of the passport, scan the chip, and scan your face using your phone.

- For a BRP, take a photo of the BRP, scan the chip, and scan your face using your phone.

- Face Scanning:

Use your phone’s front-facing camera, align your face with the oval on the screen, look straight ahead, and keep still during the scan.

What are the benefits or changes expected with the introduction of One Login?

According to the government, One Log in will change how people access government services by providing a single, unified platform for all interactions.

Here are three key advantages that make this streamlined system a game-changer for users and the government.

- Simplified Access: One Login streamlines the process of accessing government services by requiring just one account, one username and password, and one identity check. This eliminates the need for multiple accounts and reduces the hassle of remembering different sign in credentials.

- Cost and Time Efficiency: Consolidating the various sign in methods into a single platform will save over £700 million and significantly reduce the time and effort required for both users and government departments. Currently, there are around 191 different ways to set up accounts and 44 different sign-in methods, which are costly and inefficient.

- Wide Adoption and Ease of Use: By 2025, over 100 public services, covering most central government services, will use One Login. The One Login app, which allows users to quickly, easily, and securely verify their identity using their smartphone, has already been downloaded two million times and successfully used by over 1.5 million users.

When will HMRC begin migrating users to One Login?

HMRC began migrating users to One Login in Spring 2024. Initially, they focused on new users without a government service account and some existing customers. At the same time, they are onboarding government agencies and services, raising awareness about the new system and highlighting its benefits in streamlining processes for service providers.

How will the migration process be carried out for Gateway users?

HMRC still needs to detail the exact migration process. Only new taxpayers can access the service while existing users are asked to wait until later. Over the next few months, individuals, businesses, and agents will likely receive prompts to complete identity verification on One Login. The migration will be gradual, with increasing volumes over time, and is expected to be fully completed by the end of the 2024/2025 tax year, which is March 2025. Users may also proactively request to use the service during this period.

Contact details for Government Gateway

For business or personal tax account queries, please contact HMRC at 0300 200 3600. If you are calling from outside the UK, use +44 161 930 8445. Their phone lines are open Monday through Friday from 8 a.m. to 6 p.m. and are closed on weekends and bank holidays.

read

Register Your Company and Get a Certificate of Incorporation

Are you looking to register your company? Learn how to get your certificate of incorporation, including the online application and replacement procedure.

🔑 Key Highlights

- A certificate of incorporation is conclusive evidence that your company has been duly registered with Companies House.

- You can call Companies House or use their search service to get a hard copy of your certificate.

Certificate of Incorporation Defined

A Certificate of Incorporation proves that your company has been officially registered at Companies House under the Companies Act and is recognised as a legal entity in the UK. It signifies that your business is now separate and distinct from its shareholders and directors, operating independently under the law.

Who needs a certificate of incorporation UK?

A certificate of Incorporation is essential for various entities and individuals registering a company in the UK. Here's a breakdown of who needs one:

- Entrepreneurs registering a limited company by shares — Whether establishing a public or private company, entrepreneurs seeking to set up a business structure where ownership is divided into shares require a registration certificate.

- Individuals establishing charitable organisations — Individuals or groups intending to establish charitable organisations with limited liability protection in the UK that operate under a company limited by guarantee structure also require a certificate.

- Partners Forming Limited Liability Partnerships (LLPs) or Limited Partnerships (LPs)—Partners seeking to enjoy limited liability protection can opt to form LLPs or LPs. In both cases, obtaining a certificate of incorporation is necessary to formalise the registration process and establish the legal entity's existence.

The certificate is official proof of the company's legal incorporation and is essential for conducting business activities and fulfilling legal requirements.

See also: What does limited liability mean?

Which company details are found in a certificate of incorporation?

Once Companies House has approved your registration application, you will find the following details in an incorporation certificate.

- The type of company such as a private or public company, LLP or another legal entity structure.

- The registration number uniquely identifies the company and depends on the entity type. For example, a partnership will have a partnership number, while a private limited company will have a company registration number (CRN).

- The certificate indicates the official date of incorporation or registration.

- The full legal name under which the company is registered is provided in the certificate.

- Registrar information may be from Companies House in England and Wales, Companies House Scotland, or Companies House Northern Ireland.

- Depending on the jurisdiction, formation jurisdiction may be Cardiff, Edinburgh, or Belfast.

- Relevant legislation or laws under which the company is formed provide the legal context for its establishment, e.g., the Companies Act (2006) or the Limited Liability Partnership Act (2000)

Company Name Requirements for a New Company in the UK

When registering a new company in the UK, the name displayed on your certificate of incorporation must adhere to specific criteria set by Companies House. To ensure approval, your company name must meet the following requirements:

- Uniqueness — The proposed name must not closely resemble an existing company name, helping to avoid confusion among consumers and stakeholders.

- Exclude official terms — Avoid incorporating terms like "Royal" or "Government" to imply an association with any local or national UK government agency, as these terms require official authorisation.

- Avoid sensitive words — Exercise caution when using sensitive words like "Chartered" or "Accredited," ensuring proper authorisation is obtained before inclusion.

- Appropriateness—The name should be appropriate and not offensive, inappropriate, or likely to cause harm, maintaining professionalism and respectability.

- Compliance with legal standards — Ensure the name does not suggest criminal activities contrary to the public interest, adhering to legal standards and ethical principles.

How to Register Your Company With Companies House

Here is what you need to form your company directly with Companies House:

- Company name — Choose an appropriate name for your company. Ensure it's unique and complies with Companies House regulations.

- Officer details — Provide information about the company directors and persons with significant control (PSCs), including their names, addresses, and other relevant particulars.

- A registered office address — The official address for receiving statutory mail.

- Memorandum and articles of association—Outline the subscribers' initial commitment to establish a company and rules for internal management, respectively.

- Correspondence address for the officers — For receiving statutory letters and legal notices relevant to their role.

- Share structure — Determine your company's share structure, including the number of shares and their respective values.

- Standard industrial classification (SIC) code — Identify the appropriate SIC code that best describes your company's primary activities.

Once you have these details ready, you can initiate the registration process. The cost for setting up a limited company directly with Companies House is £12, and the process typically takes around 12 hours to complete.

To begin your company formation journey, visit the following link:

https://www.gov.uk/limited-company-formation/register-your-company

Here's how you can take advantage of our free company formation offer:

- Obtain privacy addresses – Protect your company officials, including directors, persons with significant control, and shareholders. Maintain confidentiality and protect personal information.

- Invest in virtual office packages — Our comprehensive virtual office package is designed to provide a professional business address, mail handling services, and more.

- Choose resident or non-resident formation packages — Choose from our range of resident or non-resident formation packages, which include complimentary UK company setup addresses and secretarial services.

With Your Virtual Office London, you can streamline the company formation process and focus on driving your business forward. Experience hassle-free registrations and comprehensive support every step of the way.

Further insights on incorporating a company: Register & Thrive: UK Company Formation Made Simple

How to Get Another Certificate if You Lose One

Always keep your certificate of registration in a safe and easily accessible place so you can quickly produce it when needed.

However, if you lose your original certificate of incorporation. You can get a copy of the certificate online since Companies House service provides free access to company details and filings through the following steps:

- Visit the Find and Update company information service at https://find-and-update.company-information.service.gov.uk/

- Enter your company number or name in the search box.

- Select your company from the list.

- Click on "Filing history."

- Scroll down and choose "View PDF" next to Incorporation (you may need to navigate to older pages).

- Download a PDF copy of your certificate.

You can obtain a certified copy of your certificate of incorporation by calling Companies House on 0303 1234 500 and providing the company's CRN. The standard service costs £15.00, while the same-day service costs £50.00. Digital copies can also be requested via email.

How to Get a Certificate of Incorporation Via Companies House Directly

Companies House sends a company’s certificate of incorporation to the company in the following ways:

- By post — You’ll be sent a certificate of incorporation through the post to the company's registered office address as Companies House approves your application.

- Digital certificate —You can also download a digital copy of your certificate from the Companies House website by searching for a company and accessing its filing history.

- Ordering a certified copy—If a company has misplaced its original certificate, it can order a ‘printed certificate of incorporation’ from the Companies House by calling its contact centre. The standard service cost is £15, and the certified copy is delivered within 4 working days.

In summary, Companies House primarily delivers the certificate of incorporation by sending the original printed version to the company's registered office through the post. Companies can also obtain digital or certified copies of the certificate as needed.

How to Get a New Certificate if You Change Your Company Name

After your company is incorporated, tell Companies House when you want to change its name. You'll be issued a Certificate of Incorporation on Change of Name via email, reflecting the new company name while retaining all other details, such as the company registration number and incorporation date, identical to those on the original certificate.

read

The Difference Between a Voluntary and Compulsory Strike Off

All you need to know about voluntary and compulsory strike off and how to prevent your company from being removed from the companies house register.

🔑 Key Highlights

- Strike off is the process of removing a company name from the companies register, after which it ceases to exist.

- There are two types of strike off - voluntary, initiated by the directors of a solvent company and involuntary initiated by Registrar of Companies against a limited liability company that fails to comply with its legal responsibility

- The consequences of a compulsory strike off can be adverse including fines, personal liability for business obligations and disqualification from acting as a director of a company.

Let's dive into what happens when you receive a notice from Companies House about your company facing a possible strike-off.

What Is a Compulsory Strike Off?

It is a term used to refer to an action taken by Companies House to remove a company from its register so that it is formally dissolved and ceases to exist. Companies flagged for strike-off are usually not actively trading or consistently fail to meet legal and regulatory responsibilities such as filing accounts or confirmation statements.

How does the compulsory strike off process work?

The Registrar of Companies will mark a company for compulsory liquidation for the following reasons.

- Failing to comply with statutory filing requirements — One of the top reasons the Registrar may forcibly strike off a company is failure to comply with filing requirements such as confirmation statements and accounts. Beyond being struck off companies and its directors may face serious consequences, including potential criminal or personal liability charges for non-compliance.

- Not actively trading and failing to comply with dormant company requirements — If a company is not actively trading and fails to meet the requirements of a dormant company, it exposes itself to the risk of being struck off.

- Absence of a director — When a company's sole director resigns or is removed by a shareholder vote, leaving the company without directors, it makes it eligible for strike off.

- Failure to notify the Registrar about a change in their registered office address — Neglecting to inform the registrar of a change in your registered office address can cause the company to be struck off.

❌ Warning

The unauthorised Use of a Registered Office Address is strictly prohibited. According to the Companies (Address of Registered Office) Regulations 2016, if any individual or entity submits an RP07 application to change a company's disputed registered office address, the registrar may deem the company unauthorised to use that specific address.

Failure to contest the application or present adequate evidence within 28 days will result in the Registrar changing the business address to the default Companies House address. Continuing to operate with the default address is not permissible (and maybe a basis for being struck-off the register), and immediate action is required to update it to an authorised limited company address.

The default address is published on the public register, and even if a company updates the registered office from the default address, the previous default address will always be publicly available, signalling that the company used an address without permission.

However, if you fulfil all of your legal obligations and have reason to believe that the strike-off notice is unfair, you can send an objection application to Companies House. If your reasons are viable and you provide satisfactory evidence, the process will be discontinued.

For any company that fulfils any of the above conditions, the Registrar of Companies for England and Wales, Scotland, and Northern Ireland may initiate the process of striking them off the register as follows —

1. Companies House inquiry

The process starts with Companies House sending letters to inquire about the business's current trading status and giving them 14 days to respond. In the absence of a reply, a follow-up letter with identical inquiry is issued, granting an additional 14 days for a response.

2. Issuance of a first gazette notice for compulsory strike

If the company fails to respond to the second letter of inquiry, Companies House issues a notice published in the Gazette in London, Edinburgh, or Belfast—depending on the geographical location of the company’s registered office.

The primary purpose of this notice is to declare their intention to strike off the company formally. It serves a dual role: providing management with an opportunity to take corrective measures and allowing creditors (including HMRC or former employees owed) the chance to raise objections.

Remember, the strike-off implies that the company will cease to exist, preventing creditors from pursuing and collecting outstanding payments.

✅ Insight

When facing insolvency, it is advisable to explore alternative solutions, including a Creditors’ Voluntary Liquidation (CVL), to avoid the negative consequences of an involuntary strike-off. In a CVL, a licensed insolvency practitioner takes charge of winding up the company and liquidating its assets for the benefit of creditors. Additionally, they may guide on potential eligibility for director redundancy payments from HMRC and other associated benefits.

3. Second Gazette Notice

If there is no response to the first notice, a second notice is published, providing a final opportunity for any concerned party to correct or object to the closure.

4. Dissolution and Cessation of Business

If there are no objections and the company officials take no action, the company is removed from the register and ceases to exist.

5. Asset Forfeiture

The Crown may claim assets, such as cash, machinery, or buildings, under the 'bona vacantia' (meaning ownerless goods) principle.

Directors may face an investigation into potential misconduct that led to the strike-off. If wrongdoing is found, it could lead to disqualification and even personal liability for company debts.

What Is Voluntary Strike Off?

According to section 1000 of the Companies Act 2006, a voluntary strike off is a process initiated by company directors to remove the company from the register and essentially close it down. It happens when a company is no longer in active business, and directors are happy for the company to close.

A business that fulfils the following conditions is eligible for voluntary strike off —

- During the three months before the application for voluntary strike-off, the company should not have conducted any business transaction.

- The company must have kept its name the same within the last three months.

- It should be financially stable and not at risk of liquidation.

- There should be no outstanding agreements with creditors, e.g., a Company Voluntary Arrangement (CVA), to avoid unresolved issues hindering the voluntary strike-off.

If the entity meets the above criteria, it must ensure that —

- All tax and debt liabilities have been addressed and settled for a clean financial record before closing.

- The company in question should make its employees redundant and pay their final wages if applicable. HMRC should also be informed that the company is no longer an employer.

- Business assets should be appropriately distributed among shareholders according to the company's structure and agreements.

- It filed its final annual accounts and Company Tax Return with HMRC to provide a formal record of the company's last trading period and impending closure.

In essence, meeting the eligibility criteria for voluntary strike off allows the company to wind down its operations systematically. Ensuring the resolution of financial and employee-related matters, proper asset distribution, and finalising the necessary documents with HMRC contribute to a smooth and legally compliant closure process.

A copy of the strike off application needs to be sent within seven days to the following parties potentially impacted by the liquidation so that they do not object —

- Members/shareholders

- Creditors

- Employees

- Managers or trustees of any employee pension fund

- Directors who did not sign the application form

The request for the company's strike-off will be publicised as a notice in the local Gazette if the form has been accurately filed. After two months without objections, the company will officially be off the register. Subsequently, a second notice will be Gazetted to confirm the official closure of the company.

What is the difference between voluntary and involuntary strike off?

| Criteria | Voluntary Strike Off | Involuntary Strike Off |

|---|---|---|

Initiator |

Company directors or shareholders using a DS01 form. |

Companies House initiates the process |

Reasons for the strike off |

The company is solvent. Officials take a strategic decision to cease trading and close the company. |

The company has failed to meet legal, financial, or regulatory responsibilities. |

Publication notice |

The registrar will publish a notice of the proposed striking-off in the relevant Gazette to allow interested parties the opportunity to object. |

Companies House publishes the first notice, for objections to be raised or for the company to take remedial action. |

Assets |

The company handles the distribution of assets and settles liabilities before termination. |

Company assets, if any, are forfeited to the Crown. |

Eligibility |

Conditions include no threat of liquidation, not actively trading for the and no recent name change in the last three months. |

Failure to meet legal obligations. |

Final confirmation Gazette Notice |

A final notice is published confirming the closure. |

A notice is published by the Registrar confirming the closure. |

Outcome |

Once the process is completed, the company will be struck off and cease to exist. |

The company is dissolved. |

Consequences |

Generally, smoother closure with minimal legal repercussions. |

Serious consequences for the company and its directors. For example, being personally liable for company obligations, fines, disqualification from acting as a company director for two to fifteen years, potential investigation for non-compliance, and even custodial sentences. |

How can a company avoid compulsory strike off after receiving a request to strike?

If you want to avoid an involuntary strike-off, send an objection application to the Registrar of Companies as soon as possible. To make and submit it, you’ll need -

- To sign in to or create a Companies House account;

- Details of the company facing the strike off; and

- Evidence to support the objection, for example, invoices showing the company is still trading or owing a debt. These documents must show the company's full name and be at most six months old.

Furthermore, the company should ensure that all their annual accounts and confirmation statements are filed on time. If you need extra time to get your filings in order, please communicate with Companies House.

When can creditors object to a compulsory strike-off?

Creditors and concerned parties, including shareholders, can object to a strike-off after the issuance of the first gazette notice. The gazette notice serves as public notification about the Registrar of companies intent to be strike it off the register.

Why would a company compulsorily be struck off the register?

A company is usually subject to involuntary strike-off from the register when it fails to meet statutory requirements, including the timely submission of accounts and confirmation statements. The directors, shareholders, and external creditors like suppliers and HMRC have a two month window to raise objections against the application. If no objections are presented, the company will be struck-off from the register, leading to its dissolution.

What do I do after Getting the Gazette First Notice for Company Strike Off from Companies House?

Once you receive the first notice, you have two to three months to rectify the situation. Here are steps to consider —

- Determine the reason for the strike off — To remedy the situation, address the reason behind the notice, which may involve submitting your filings or proving that you are still operational.

- Apply for suspension — If you need more time to remedy the reasons behind the strike-off notice, prepare and lodge a suspension application to Companies House.

- Address outstanding issues — Clear any fees and taxes and update your filing requirements to stop the process from proceeding to the next step.

✅ Insight

Once the registrar initiates an involuntary strike-off, it is highly advisable to seek the assistance of a seasoned professional, such as a solicitor or accountant. Their expertise can prove invaluable in navigating the complexities associated with this procedure, increasing the likelihood of a smoother and more successful outcome for your company.

Can I stop a compulsory striking off notice?

Yes. You can halt a compulsory striking off notice directed at your company by resolving the underlying issues specified in the notice.

You can also apply to object to a company being struck off using a Companies House account if, for instance, it's indebted to you. Have the company details and documentation demonstrating that the company is still actively trading or has outstanding arrears.

FAQs

What if my company is insolvent?

If you want to close your company but it is insolvent, do all you can to avoid a compulsory strike-off, which will have negative consequences. Instead, you can opt for —

- Creditor’s Voluntary Liquidation (CVL), which involves appointing an insolvency practitioner to liquidate assets and distribute them proportionally to outstanding creditors.

- Company Voluntary Agreement between the company and its creditors allows it to continue trading under the supervision of an insolvency practitioner and pay its debts over time.

- Pre-packed Administration - The company can continue to trade under a pre-packed administration, which entails negotiating a sale of the company's assets before formally entering administration. By doing so, the business can swiftly transition to new ownership, potentially preserving jobs and ongoing operations.

Compulsory strike off consequences - What if I have assets in my company?

In the event of a compulsory strike-off, company assets will not remain under your control, nor will they be distributed according to the company's plans. These assets will be released to the Crown. It's essential to be aware of this consequence, as it emphasizes the importance of promptly addressing the compulsory strike-off notice and considering alternative options to safeguard your company's assets.

What are my options following a request to strike off?

Suppose a third party has forcibly struck your company off the Companies House register. In that case, you have the following options: if you –

- Have no outstanding arrears obligations and all assets have been realised simply allow the process to run its course.

- Believe the strike off is unjust, or the details are incorrect, you’ll need to prepare and submit a suspension application and engage the registrar for it to be discontinued.

- What to embrace the strike off but have assets and unpaid obligations, best pursue a voluntary liquidation.

How can I restore a company to the Companies House register?

Depending on the circumstances, there are two main ways to restore a dissolved company: administrative restoration and restoration by a court order.

1. Administrative restoration

You can only apply if the —

- Person or entity seeking the restoration was a director or shareholder

- Company was struck off the register and dissolved by the Registrar of Companies within the last 6 years

- Company was trading at the time it was dissolved

You apply for administrative restoration by sending to the Registrar a —

- Completed application for administrative restoration (form RT01)

- Cheque for £100, payable to ‘Companies House’

- Any outstanding documents, such as accounts or confirmation statements

- Any filing fees or penalty payments

if your company had assets, a waiver letter from Bona Vacantia.

If your application has been successful, your company will be restored as soon as the registrar sends you a confirmation letter.

If your application is refused, you might be able to:

- apply for a court order to have your company restored

- get a discretionary grant (if you were a shareholder and need to claim some money back)

2. Court order restoration

You may be able to apply for a court order to restore a company if you:

- Did business with them

- Was an employee

- They owed you money at the time of the closure

- Were responsible for their employee pension fund

- Have shared or competing interest in land

- Were a shareholder or director when it was dissolved

To apply for a court order restoration in England and Wales, download and fill Form N208.

For assistance in completing Form N208, access guidance notes from the HM Courts and Tribunals service.

Next, you’ll need to find the company’s registered office and send the completed form to their nearest bankruptcy county court. Contact the Royal Courts of Justice if you need clarification on the appropriate court.

Include the following with the application:

- A £280 court fee (cash, postal order, or cheque made payable to ‘HM Courts and Tribunals Service’)

- A witness statement incorporating the supporting details specified in section 4 of the Treasury Solicitor’s Guide to company restoration.

In Scotland:

Apply to the Court of Session if the paid-up capital of the company's shares exceeds £120,000.

For other companies, apply to the local sheriff's court. Subsequently, serve a ‘petition to restore’ on the Registrar of Companies in Scotland and any additional entities as directed by the court.

In Northern Ireland:

Submit an ‘originating summons’ to the Royal Courts of Justice using the address below.

Royal Courts of Justice

Chichester Street

Belfast

BT1 3JY

Send a copy to the Registrar of Companies in Northern Ireland and a supportive witness statement.

The Registrar of Companies

Companies House

Second Floor

The Linenhall

32-38 Linenhall Street

Belfast

BT2 8BG

Upon acceptance of the claim, the court will issue an order to restore the company. Forward this order to the Registrar of Companies. Once received, the Registrar will proceed with the restoration of the company.

Consequently, take the following steps to pursue outstanding payments:

- Obtain a ‘judgment’ from the court, specifying the debt amount, interest, and costs.

- Issue a statutory demand.

- File a winding-up petition.

read

Your HMRC UTR Number Explained

Everything you need to know about registering for self assessment, applying for a UTR number for your company, or filing tax returns.

🔑 Key Highlights

- UTR serves as a unique identifier for businesses and individuals, including sole traders.

- Once assigned, the number remains valid for the lifetime of the individual or business entity.

- The number provides access to various online services HM Revenue and Customs offers, enabling taxpayers to manage their accounts, submit tax returns, and stay updated on their financial obligations.

What is a Unique Tax Reference Number?

HMRC issues a unique taxpayer reference comprising ten digits (e.g., 0123456789) to all taxpayers, whether they are limited companies, self-employed individuals, or sole traders.

Personal UTR numbers are issued immediately after a self-employed individual files for self-assessment, while UTR numbers are given directly after incorporation.

Why do I need a UTR Number?

UTR numbers are unique to the holder and, therefore used to identify a person or business for the purpose of taxation. Limited companies use UTR as a reference number when they are -

- Filing returns to HMRC;

- Communicating changes in their accounting period;

- Informing HMRC about changes in their registered details or company structure or

- Transitioning from active to dormant company.

Individuals on self-assessment use a UTR for reference when communicating to HMRC in the following instances —

- File a self-assessment tax return online or via post;

- Work with accountants or other financial advisors;

- Determine their tax bill and pre-pay taxes;

- Claim refunds;

- Track compliance with tax obligations; and

- Ensure accurate record-keeping for tax-related matters.

The reference number helps HM Revenue and Customs track earnings, calculate their liability, and monitor the fulfilment of tax obligations.

How to Register for a UTR Number From HMRC as a Self-Employed Sole Trader

You will be issued a UTR number during self-assessment registration or when forming an LTD company. To enroll for self assessment with HMRC online, you’ll need a Government Gateway ID and password. If you do not have a business account, you can create one if you are -

- Self-employed as a sole trader

- A business partner, or

- You need to pay for any other reason; for example, you earn income from a rental property.

🛈 Information box

If you’re self-employed, you’ll need to sign up for UTR and Class 2 National Insurance by filling out a CWF1 online form and posting it. Once you register, you’ll get your UTR number by post in 15 days or 21 if you are abroad.

If you’ve joined a registered partnership, print and post from SA401, or create your Government Gateway credentials and do it online.

For any other reason, you’ll need to provide your full name, postal address, telephone number, and UK national insurance number and indicate why you are registering for self-assessment.

To avoid fines, remember the deadline for when you must file returns.

However, if you’ve ever registered but have not yet received your UTR number, contact HMRC directly through the self assessment helpline on 0300 200 3310. They will post it to you, and this takes around ten days.

Take time to memorise your number, just like your National Insurance number, it’s yours for life.

How to find your UTR number online?

If you’ve forgotten your UTR number, there are several ways to retrieve it.

✅ Insight

You can get the number on your personal tax account or the HMRC app, accessible as an iOS App from the App Store or Android App from the Google Play Store using your Government Gateway ID and password to access your details.

Most of your documents from HMRC will show your UTR number; refer to any tax returns letters you receive or forms such as a P60 or P45. Your corporation UTR number will also be printed on your payslip.

See if you can find your UTR number in any of the following resources —

- Get your registered name and number for a ltd company and request your corporation tax UTR online.

- Search through your online Self-Assessment account on the HMRC website.

- Check your “Welcome to Self Assessment letter” (Letter (SA250) sent by HM Revenue & Customs.

- In your “Corporation Tax Information for New Companies” letter (CT41G) sent by HMRC to the official company address

- Any official correspondence, letters, or notices sent to you by HMRC, for instance, notices for tax payments or statements of accounts.

- Previous self assessment, company tax returns and other documents.

However, if you still can’t access previous tax documents (or you want to check your company UTR number), get in touch with HM Revenue & Customs through the self assessment helpline, and they’ll post it to you in 10 working days, or to the registered company address in case of a company utr number.

How do I get a UTR number if I am a Non-Resident?

The law requires non-residents to pay taxes on their UK earnings but not their foreign income. If you are a non-resident, you can apply for UTR through the Government Gateway with the necessary credentials. To get them, you’ll need to have lived in the UK at some point and at least have a National Insurance number (NINO).

If you do not have NINO, it is possible to register for self-assessment using form SA1, used by those who need to register for UTR number for reasons other than self-employment. As you fill out the PDF, indicate the reason for not providing your NINO.

Next, you will be asked why you must complete a tax return. Some of your options include if you are -

- Receiving annual income from a trust or settlement;

- Earning an annual income of over £100,000;

- Getting untaxed income that cannot be collected through your PAYE tax code;

- Earning Income for Child Benefit purposes of over £50,000, and you or your partner is entitled to receive Child Benefit payments on or after 7 January 2013; and

- Required to pay Capital Gains Tax to pay.

If you have other reasons for completing your returns, you will be required to give the relevant details.

Once you obtain a UTR number, you can create a Government Gateway account, sign up for HMRC online services, and file self assessment tax returns.

For a non-resident company or a collective investment vehicle (CIV) that operates in the country or owns UK-based assets such as shares or land, you are liable to pay your company tax using form CT600 corporation tax return. To file your returns, you will need to provide the following details —

- Company name (prior names if applicable), registered overseas address, and all contact details.

- Date of incorporation

- Name and addresses of directors

- The date you became liable for company tax

How do I register for a Company UTR?

To record your company as “active” with HMRC for tax (this must be done within three months of starting any form of business activity or receiving business-related income), you’ll have to provide the following details:

- Company name and company registration number (CRN);

- Trading start date (this will determine the start date of your initial corporate tax accounting period);

- Main address where your business activities are active (this doesn’t have to be your registered office address);

- Outline your company’s principal activities (your SIC code will be needed here).

- The date your company accounts will be noted is also known as the “Accounting Reference Date (ARD).” It is the anniversary of the last day of the month of your business formation;

- Any other information on whether you’ve taken over an existing company/or are part of a group; and

- Comprehensive details of all company directors (names, addresses, National Insurance number).

If applicable, any information regarding the appointment of an agent (accountant/tax advisor) who handles your company’s tax-related issues.

How long does it take to get a UTR?

How long it takes to get a UTR depends on your circumstances.

- Individuals register for self assessment online and get their UTR number within ten working days.

- Non-resident individuals with all the necessary documentation can get their UTR within 21 working days after enrolling for self assessment on the HMRC website. Non-UK resident landlords can register for the Non-resident Landlord (NRL) scheme by calling or writing to HM Revenue and Customs using the following details:

|

|

- For a limited company registered with Companies House, HMRC will automatically get a notification of their formation and send their UTR number within 14 days of incorporation.

- Non-resident corporations must register for corporate tax within three months of becoming liable to pay UK corporate tax. If the corporation has a Government Gateway User ID, HMRC will send the code online. If not, the company will need to create an account and allow up to 8 weeks to process the registration and get access codes to your overseas address.

I lost my UTR number; what do I do?

For lost UTR, don’t worry. Simply look through your correspondence with HM Revenue & Customers. If you cannot trace it, you can call HMRC on 0300 200 3310 to ask about your number and +44 161 931 9070 for those outside the UK. HMRC cannot give your UTR number over the phone, but they’ll send it to you by post in 10 working days.

What is the difference between a UTR Number and a Tax Code?

A UTR number and tax code are tax-related numbers in the UK but for different purposes. A unique tax reference is a 10-digit number identifying an entity for taxation matters issued by Her Majesty Revenue and Customs (HMRC) to individuals or companies.

On the other hand, a tax code is used to identify employers, pension providers, and taxpayers within the context of withholding tax that combines numbers and letters with a distinct meaning. The numbers in a tax code represent the tax-free income an employee can earn in a year, while the letter reflects the employee's situation and how it affects the employee. Therefore, tax codes are not static (they change every year) and are not unique to individuals, and there are situations where two or more people with similar tax dynamics can have the same code.

Currently, the most common tax code is 1257L, which means you can earn up to £12,570 before HMRC requires you to pay your income tax. The letter L means the employee is entitled to the standard tax-free personal allowance. Other letters, such as M, mean the employee has received a transfer of 10% of your partner’s Personal Allowance.

What is a tax return?

Taxpayers must file annual returns with HMRC by post or online, declaring their income and any other relevant financial details helpful in calculating tax liability and scheduling payments or requesting refunds in case of an overpayment. The form is called self assessment because each individual is responsible for reporting their income.

What are the Self Assessment deadlines?

To not miss a deadline, you first need to know that tax dates do not go according to calendar years and are filed in arrears (for the previous year’s income). For instance, when submitting forms in 2023, you are reporting based on 2022 income.

The present tax year starts from April 6, 2023, to April 5, 2024, shortened as 2023/2024, and HMRC requires that self assessment returns be filed by October 5, 2024, if it was your first time filing. Midnight October 31, 2024, and January 31, 2025, are the deadlines for filing a paper tax return and online filing, respectively. HMRC also requires that you pay taxes you owe by January 31, 2025.

Who needs to file a self assessment Tax Return?

In the UK, most people pay tax at source in the form of PAYE (Pay as You Earn) and are not required to file for self assessment. However, according to HMRC, you must file a self assessment tax return (known as an SA100) if, during the tax year, you were -

- Self-employed as a ‘sole trader’ and earned more than £1,000 (before taking off anything you can claim tax relief on);

- A partner in a business partnership, a minister of religion, or a trustee;

- A resident or non-resident who earned over £2,500 in terms of an untaxed interest, rental income, commission, etc;

- Earned over £10,000 before tax in savings and investments or have You have an annual income of £100,000 or more before tax;

- You have capital gains income received by selling or giving away shares or any other relevant asset;

- Had a total taxable income of above £100,000; and

- Had to pay the High Income Child Benefit Charge.

If you need clarification on your situation, please write to us at info@capital-office.co.uk, and we will give you all the information necessary to make a sound decision.

How do I file a Self-Assessment Tax Return Online?

You can file online using form SA100 if you are self-employed and must submit returns for reasons such as receiving rental income.

However, to file returns for a —

- Partnership use the Partnership Tax Return (SA800);

- Trust or an estate files through the Tax and Estate Tax Return (SA900);

- Non-resident using the Residence, remittance basis, etc. (Self Assessment SA109);

- Report chargeable events, such as the maturity of a life insurance policy, by filing the electronic flat text file specification (previously called magnetic media specifications) — for UK insurers only or the HMRC chargeable events spreadsheet;

- Minister of religion by supplementary pages SA102M; and

- SA103L for Lloyd's underwriters.

How do I pay my tax bill?

You can pay your self assessment tax bill by 31 January for taxes owed from the previous year through -

- Online or telephone banking (Faster Payments);

- Debit or corporate credit card online;

- Your bank or building society;

- Your online bank account;

- CHAPS or Bacs

Note that HMRC’s banking address is:

Barclays Bank PLC1

Churchill Place

London

United Kingdom

E14 5HP

What are the Self-Assessment Tax Bill Deadlines?

Submitting returns is complex; you must get the timing right to avoid penalties. Note taxation forms are not submitted based on calendar years but tax years and are filed in arrears (for the previous year’s income). For instance, if you are filing returns in 2023, you are filing for 2022 income.

✅ Insight

The present tax year starts from April 6, 2023, to April 5, 2024, shortened as 2023/2024, and HMRC requires that Self-Assessment returns be filed by October 5, 2024, if it was your first time filing. Midnight October 31 and January 31 (the following year) are the deadlines for filing a paper tax return and online filing, respectively. HMRC also requires that you pay taxes you owe by January 31.

How do you apply for a Company UTR number?

When you set up your LTD company, Companies House automatically sends a notification to HMRC to issue you with a Unique Taxpayer Reference (UTR) number.

What is the difference between a Tax Rebate and a Tax Refund?

Both terms refer to an after-tax refund a taxpayer receives after overpaying their tax invoice. The refund (rebate) refers to the sum you receive from the government when your taxes exceed your actual tax liability.

How do I file my first tax return online?

If this is your first time filing a tax return, begin by enlisting for self assessment. Complete the registration process online on the GOV.UK website. Once registered, you will be assigned a Unique Taxpayer Reference (UTR) number.

Next, gather documents such as P60, P45, and any other relevant tax paperwork. With your documents in hand, determine if you can file online or if you ought to use commercial software and follow the appropriate instructions. The deadline for submitting your tax return is midnight on the 31st of January, following the end of the tax year, and you should always expect to receive a confirmation from HMRC that they have received your return.

Any taxes you owe must be paid by midnight on the 31st of January following the end of the tax year. Various payment methods are available, including online, phone, or postal.

Remember, you can contact HMRC for support if you encounter any questions or require assistance with the tax filing process.

read

Guide to Company Limited by Guarantee

Everything you need to know about a standard company limited by guarantee, including a charity company, a CIO, right-to-manage organisations, and property management entities subtypes of CLG.

🔑 Key Takeaways

- A company limited by guarantee (CLG) is suitable for charities, social enterprises, or membership organisations who wish to enjoy limited liability protection.

- Like private limited companies, a CLG is a separate legal entity from its owners; however, unlike an LTD, company profits are reinvested to finance the institution's objective, and members are not shareholders but rather guarantors.

- The business must comply with both the official Registrar of Companies and the Charity Commission UK requirements.

A company limited by guarantee is a type of limited company in the UK registered to advance the objectives of non-profits such as clubs, charities, societies or any other institution seeking to function under the protection of limited liability.

✅ Insight

There are four main types of companies limited by guarantee —

- Company Limited by Guarantee — Registered only at Companies House for the benefit of the members without seeking charitable status.

- Company Limited by Guarantee Charity — Has the option to register with both the Registrar and Charity regulator or solely with the Commission. When registered with both, it becomes a Charity Company. However, if registered only with the Commission alone, it is termed a Charitable Incorporated Organisation (CIO).

- Company Limited by Guarantee (Property Management) — An institution registered for tenants' benefit, which may also be set up as a company limited by shares.

- Company Limited by Guarantee (Right to Manage) — Can only be an entity limited by guarantee, which gives leaseholders the right to take over the management of a property from the landlord.

In the next section, we’ll go over each in detail.

See also: What does limited liability mean?

Company Limited by Guarantee

As stated, a private company limited by guarantee is registered with Companies House, the official registrar of companies. Unlike a private limited company (ltd), the company does not have shareholders or a framework for raising funds through share capital. However, it has guarantors whose liability is limited to the value of the nominal guarantee they pledge.

Formation Requirements

- Company name, subject to the same rules as one limited by shares.

- Director and guarantor details, including name, date of birth, nationality, residential address, and service address. Guarantors can be individuals or a corporate body with perpetual succession.

- Governing documents, which include articles and memo of association.

- Details of persons with significant control (PSCs), including full name, date of birth, nationality, residential address, service address, nature of control, and three security details for online signature.

- A registered office address.

- Bank details.

- A service address for the initial subscribers, which will appear in the company public register.

- Standard Industrial Classification (SIC) code that describes the business activity.

✅ Insight

In a standard CLG, the memorandum of association specifies that the members agree to guarantee a certain amount towards the company's debts. The articles outline how the company will be managed and operated, including details on membership, decision-making processes, and financial matters.

Read also: Director Service Address vs Registered Office Address

Key Features

- The company is a legal person separate from its owners.

- Offers limited liability protection, restricting the liability of the members to the value of the guarantee provided at the point of formation.

- Incorporated and regulated by the Registrar, subject to the Companies Acts.

Company Structure

A company limited by guarantee works through the following structure —

- Directors (at least one) — Like a Ltd, members must appoint directors to manage its day-to-day operations.

- Committee and powers — Directors can delegate certain responsibilities to sub-committees.

- At least one guarantor — Similar to shareholders, they guarantee to pay a certain sum in case of insolvency.

- Meetings and voting — The members can attend meetings, vote, appoint, and remove directors.

- Company secretary — The CLG may opt to appoint a company secretary who helps the director oversee that the company complies with all statutory requirements.

- A service address for the initial subscribers appears in the company public register.

- Standard Industrial Classification (SIC) code that describes the business activity.

Filing Requirements

The CLG must file the following documents with the company’s Registrar —

- Annual confirmation statements

- Annual accounts

- Report company changes

- Accounts and company tax returns for HMRC

- VAT Returns, PAYE reports, and Self Assessment tax returns (as relevant)

The company must also maintain a register of members and a register of Persons With Significant Control.

Suitability

A company limited by guarantee is suitable for membership ventures seeking to pursue non-profit objectives for the benefit of the members under limited liability protection.

❌ Warning

Technically, according to company law, a business limited by guarantee is not a charity but is legally considered a non-profit. Non-profit institutions encompass a wide range of entities that operate for the public benefit without the primary goal of making a profit. A Charity Company, on the other hand, is a specific subset of a non-profit established for philanthropic purposes and must be registered with the Charity Commission to obtain charitable status.

Company Limited by Guarantee Charity

Depending on the registration process, two main types of charity companies are limited by guarantee. These are —

- A charity company is a CLG registered with the Registrar and the Commission.

- Charitable incorporated organisation (CIO), a CLG registered only with the Commission.

Formation Requirements (Charity Company)

✅ Insight

Charity Companies are peculiar, for they have to abide by the regulations of the Companies Act, 2006, as implemented by the Registrar, and the Charities Act 2022, as implemented by the Charity Commission. In the registration process, you first register your company with the Registrar, then incorporate it as a charity with the Commission.

On the side of Companies House registration, the following are the requirements for registering a charity company.

- To register, it is essential to ensure the charity name is available by searching both the company and charity register.

- The directors of the CLG automatically become the trustees of the charity company, and new trustees can also be appointed to add to the number.

- Objectives must pass the public benefit test.

- Governing Documents, including the articles and memorandum of association.

- Registered office address and bank details.

✅ Insight

For a charity company, the memorandum of association must clearly state that the company is formed for benevolent purposes, while the articles should outline how the company will be governed, including provisions related to charitable activities, distribution of profits, and compliance with charity regulations.

Key Features

- The company is a separate legal entity from the trustees and guarantors

- Liability is limited to the value of charity assets

- A charity is answerable to both the Registrar of Companies and the Commission.

Structure

It works through the following structure —

- Trustees who are responsible for running the entity.

- Guarantors are members of a company limited by guarantee continue to support the objectives of the venture.

- PSCs or beneficial owners who exercise control over the company.

Filing Requirements

The CLG must file the following documents with the company’s registrar —

- Annual confirmation statements

- Annual accounts

- Report company changes

- Accounts and company tax returns for HMRC

- VAT Returns, PAYE reports, and Self Assessment tax returns (as relevant)

The company must also maintain a register of members and a register of Persons With Significant Control.

Read also: Your HMRC UTR Number Explained

Suitability

A charity company is suitable for individuals or entities seeking to implement projects or programs that benefit the public or a target population.

| Understanding the Difference Between Companies Limited by Guarantee vs Charity Companies Vs Charitable Incorporated Organisation | |||

|---|---|---|---|

| Feature | Company Limited by Guarantee | Charity Company | Charitable incorporated organisation (CIO) |

Registration process |

Registered by Companies House |

Incorporated with the Commission after being registered at Companies House. |

Registered with just the Charity watchdog for England and Wales. |

Registered office address and SIC code |

Requires a registered office address, and sic codes must be provided during registration. |

Only the address of a contact person is required. |

|

Governance documents |

|

A company constitution that outlines its structure, rules and operations. |

|

Director/Trustee salary |

Can pay directors a salary for running the institution on behalf of the owners (members) for their roles and responsibilities. |

Trustees or directors are considered volunteers and are not eligible for pay unless otherwise specified in a governing document. However, such individuals may receive remuneration for services rendered in their professional capacity (and not simply for being a trustee.) |

|

Legal entity |

The company becomes a distinct legal person separate from its guarantors. |

Incorporated body with a legal status distinct from trustees and members. |

|

Liability |

Liability of the guarantors is limited to the amount provided as a guarantee. |

Only the charity is liable if the company becomes insolvent. Liability is limited to the assets of the charity. |

|

Structure |

A CLG has the following —

|

Once the CLG is incorporated and gains its charitable status, the following becomes the new structure —

|

A CIO structure includes —

|

Tax benefits |

Not automatically eligible for tax benefits |

Eligible for tax benefits. For example, the entity can reclaim an additional 25% tax on eligible donations from UK taxpayers in schemes like Gift Aid. |

|

Funding |

It relies on funding sources such as membership fees and commercial activities. Can trade to raise funds |

Eligible to rely on donations and other revenue streams, including trading, to raise funds. |

Can trade, but not allowed to depend solely on trading as a means of raising funds for itself. However, it can set up a wholly owned and controlled subsidiary for this purpose. |

Profit distribution |

Profits are reinvested to support the objectives of the company. |

Profits and assets cannot be distributed to members but are reinvested to support the charity objectives of the company. |

|

Filing requirements |

The Registrar's filing requirements

If the commission has incorporated a CLG, it can also file —

|

The regulatory burden of the CIO is simpler and lighter than that of a charity company. They are only required to file the above-listed items with the commission. |

|

Objects |

Objects must align with the company’s mission. |

Objects must be philanthropic and beneficial to the public. |

|

Compliance requirements |

Must comply with the company registrar's requirements |

Must comply with both the Registrar's and the Commission’s requirements. |

Must only comply with the Commission’s requirements. |

Suitability |

Established for the benefit of its members |

Established the benefit of the public. |

|

Difference between a Private Company Limited by Shares and a Company Limited by Guarantee

One of the key differences between a private LTD and a guarantee company is how the two legal structures treat profits. In a limited company, shareholders can opt to distribute profits to its members as dividends or reinvest them back into the company.

But, a company limited by guarantee is by nature a not-for-profit entity and the guarantors can only reinvest profits back into the business to finance their objectives but not withdraw as profits.

✅ Insight

The law does not explicitly require a CLG to not distribute profits. However, if your intention is to share profits, registering an ordinary private company limited by shares will make more sense.

| Company Limited by Shares (LTD) Vs. Company Limited by Guarantee (CLG) | ||

|---|---|---|

| Difference | LTD | CLG |

Objectives |

Established for the profit of the shareholders. |

Established to advance the objectives of membership organisations such as a co-operative or sports clubs. |

Legal structure |

Shares in the company represent the degree of ownership. |

Guarantors do not own shares or the company but provide financial backing in case of insolvency. |

Profit |

Withdraws profit as dividends for the benefit of owners. |

A CLG cannot withdraw profits from the business for the owner's benefit but must reinvest them to finance the entity's objectives. |

Liability |

Limited to the value of shares held, whether paid or unpaid. |

Limited to the value guaranteed. |

Share capital |

Company issues shares to shareholders. |

In a statement of guarantee, each member agrees to pay a certain amount. |

Conversion to a Charity |

There is no legal process for converting an LTD into a charity. |

A CLG can attain full charity status by being incorporated with the charity commission. |

Management |

Governed by directors who may or may not be shareholders. |

Governed by directors who may or may not be guarantors. |

Membership changes |

Shares can be transferred between shareholders, subject to restrictions in the articles. |

No shares to transfer; membership changes are by resolution and recorded in the register of members. |

Distribution of assets during liquidation |

Surplus assets are distributed to shareholders in proportion to their shareholdings. |

Surplus assets are distributed to other non-profit entities with similar objects. |

Yet, with the above differences, the two structures have the following similarities —

- Offer limited liability protection to the owners in case of insolvency. They will only be responsible for paying company debts up to the value of shares or guarantee.

- Registered and some of their pertinent details such as registered address, director information, shareholder and guarantor details, and filings are available in the companies register for public scrutiny.

- Are required to have one director, secretary (for public limited companies though optional for ltds and CLGs) and members (who act as shareholders and guarantors.)

- Established by a memorandum of association, signed by all the initial subscribers agreeing to start the business, and the articles outlining rights, responsibilities, and how the business will manage its operations.

- Require registered office address, director service address, and company name found to be available by searching the register.

- Have similar routes for dissolution, which can either be by voluntary strike-off, Members' Voluntary Liquidation (MVL) (for solvent companies), Creditors' Voluntary Liquidation (CVL) and compulsory Liquidation (for insolvent businesses).